References:

Available parameters

- WACC / Cost of Equity / Cost of Debt

- Risk-free rate

- Peer group-specific and 70 (sub)sector-specific beta factors (Five-, Two- and One-year-beta factors)

- Credit spread

- Market risk premium

- Country risk premium

- Inflation delta

- Average tax rate

- Selected exchange rates

Individual WACC calculation

In addition, the tool offers users full flexibility. In the parameter settings users can choose whether to use KPMG's expert parameters or use their own values for each parameter during the calculation process.

KPMG Valuation Data Source – test demo for free now

Cost of capital parameters

All the benefits at a glance

WACC at the click of a button

Direct WACC calculation and access to all relevant cost of capital parameters

Assured data quality and timeliness

Reliability and monthly updates of data ensured by KPMG experts

Currency selection

Option of selecting the cash flow currency

Individual peer group

Summary and storage option of own peer group from more than 16,500 companies worldwide

Excel download

Parameters available as Excel spreadsheet for download

Frequently Asked Questions

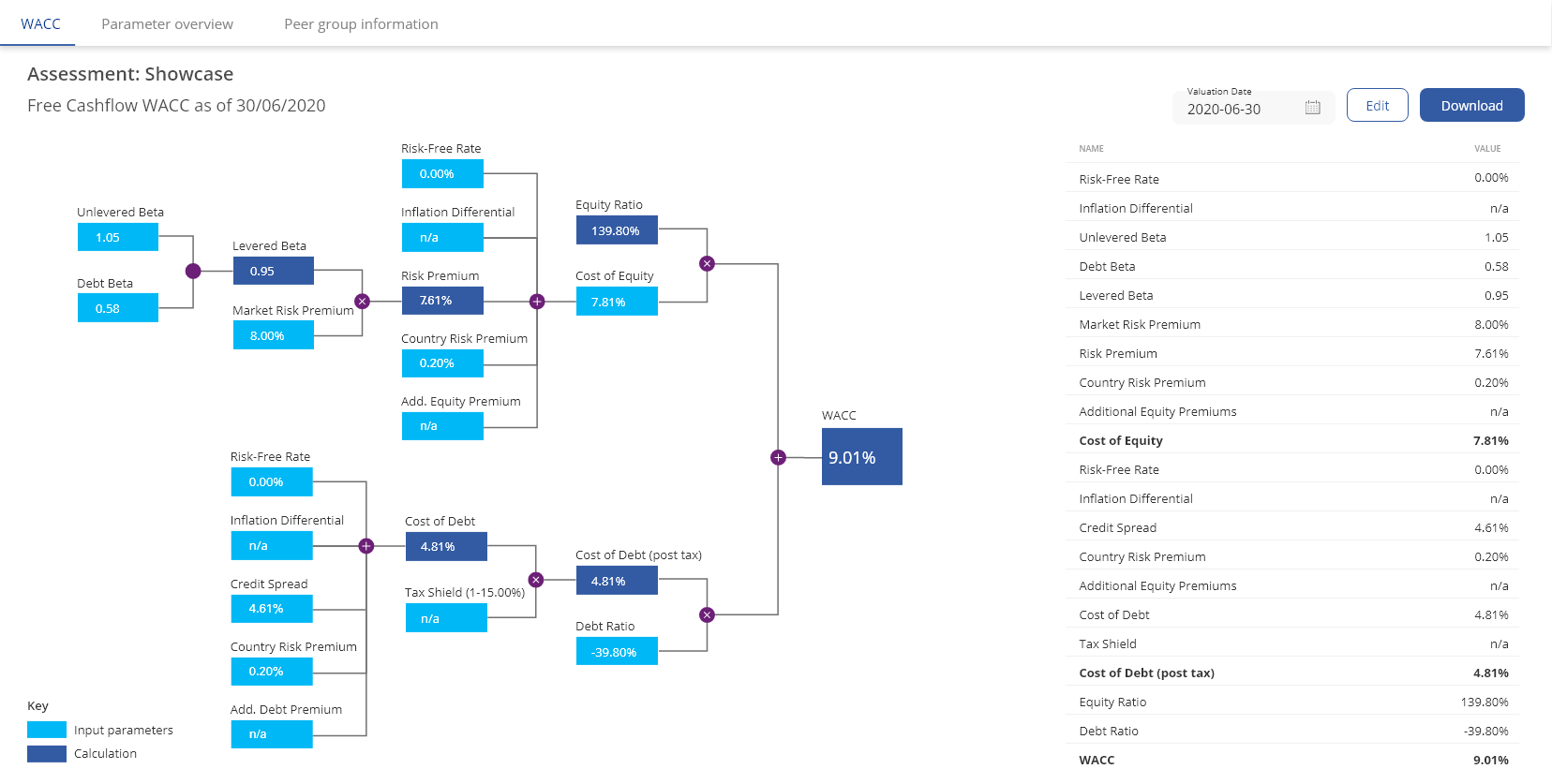

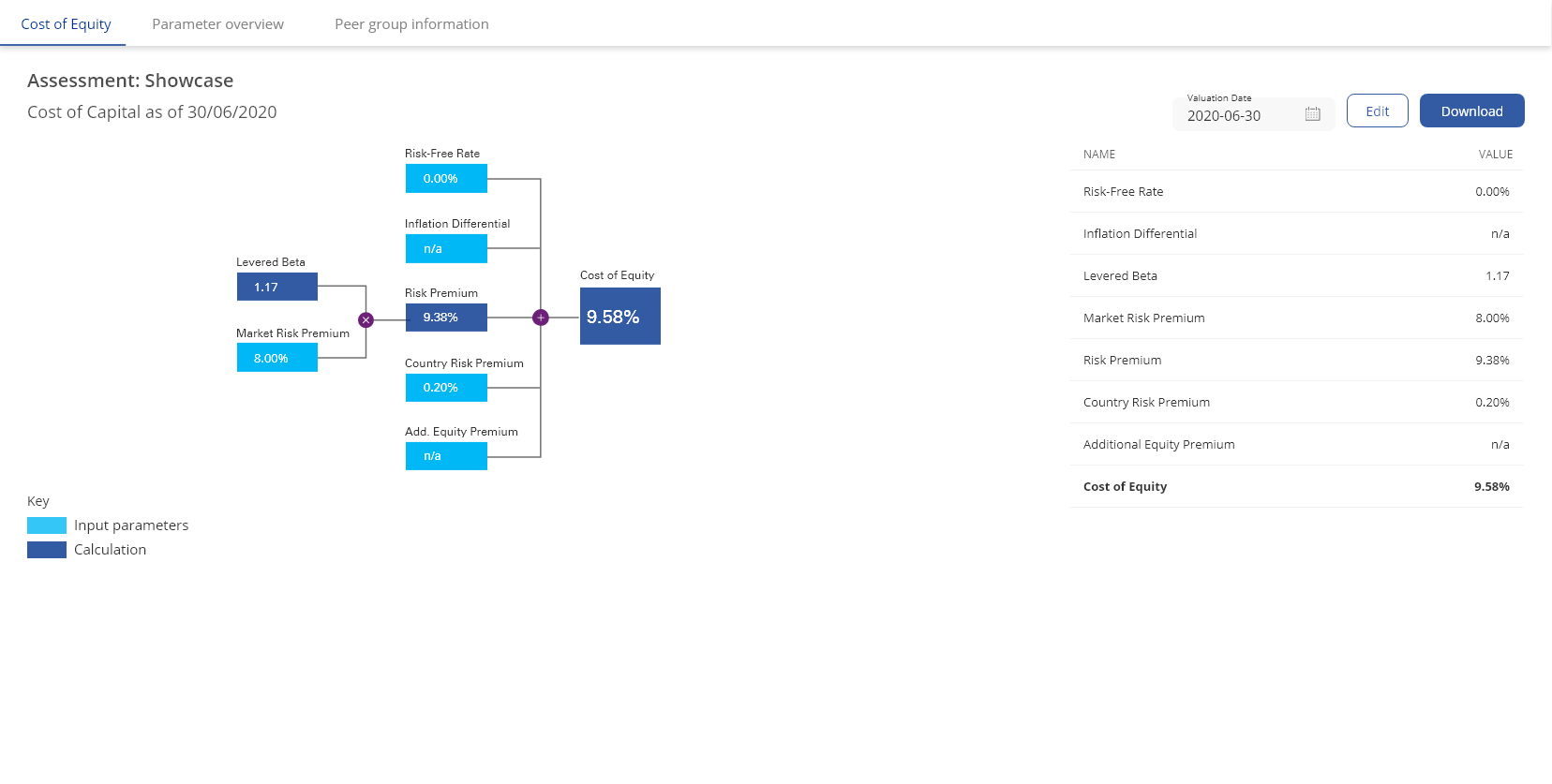

When calculating the Weighted Average Cost of Capital (WACC), the cost of equity and the cost of debt are weighted in relation to the company's capital structure. The cost of equity is calculated using the Capital Asset Pricing Model (CAPM), which considers the risk-free rate, the company's beta factor and the market risk premium.

The cost of debt is assumed to be tax-deductible and thus reduces the tax burden. They are therefore reduced by the income tax burden (tax shield).

The free cash flow WACC is made up of the weighted expected return of all investors (equity and debt capital providers) and the tax effect of debt financing ("tax shield"), as the free cash flow itself does not consider the tax effect of debt financing.

The total cashflow WACC on the other hand already incorporates the tax effects of debt financing. Therefore, it only considers the weighted expected return of all investors without including the tax shield.

With the KPMG Valuation Data Source, you can compute both, the free cash flow WACC and the total cash flow WACC.

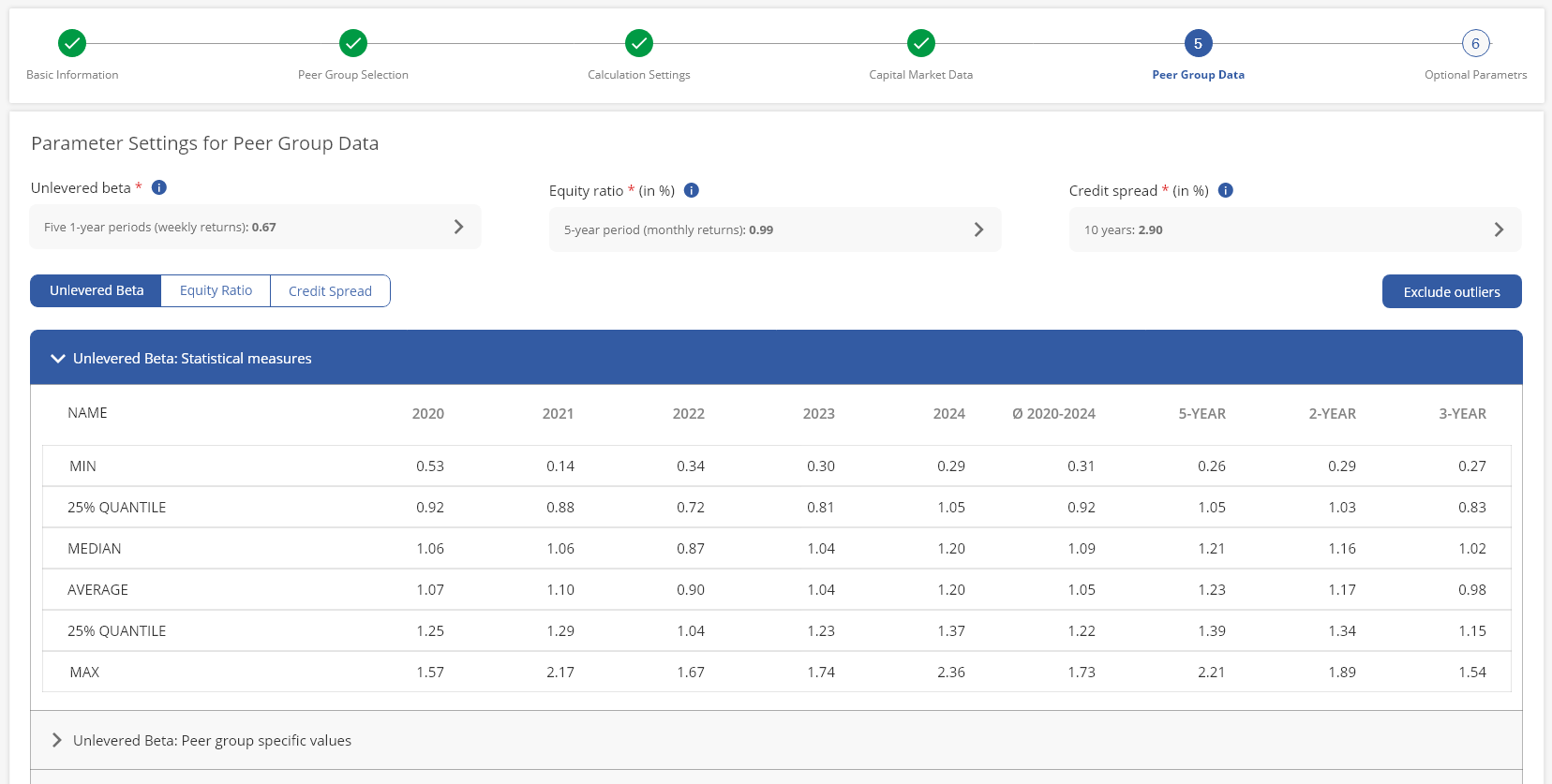

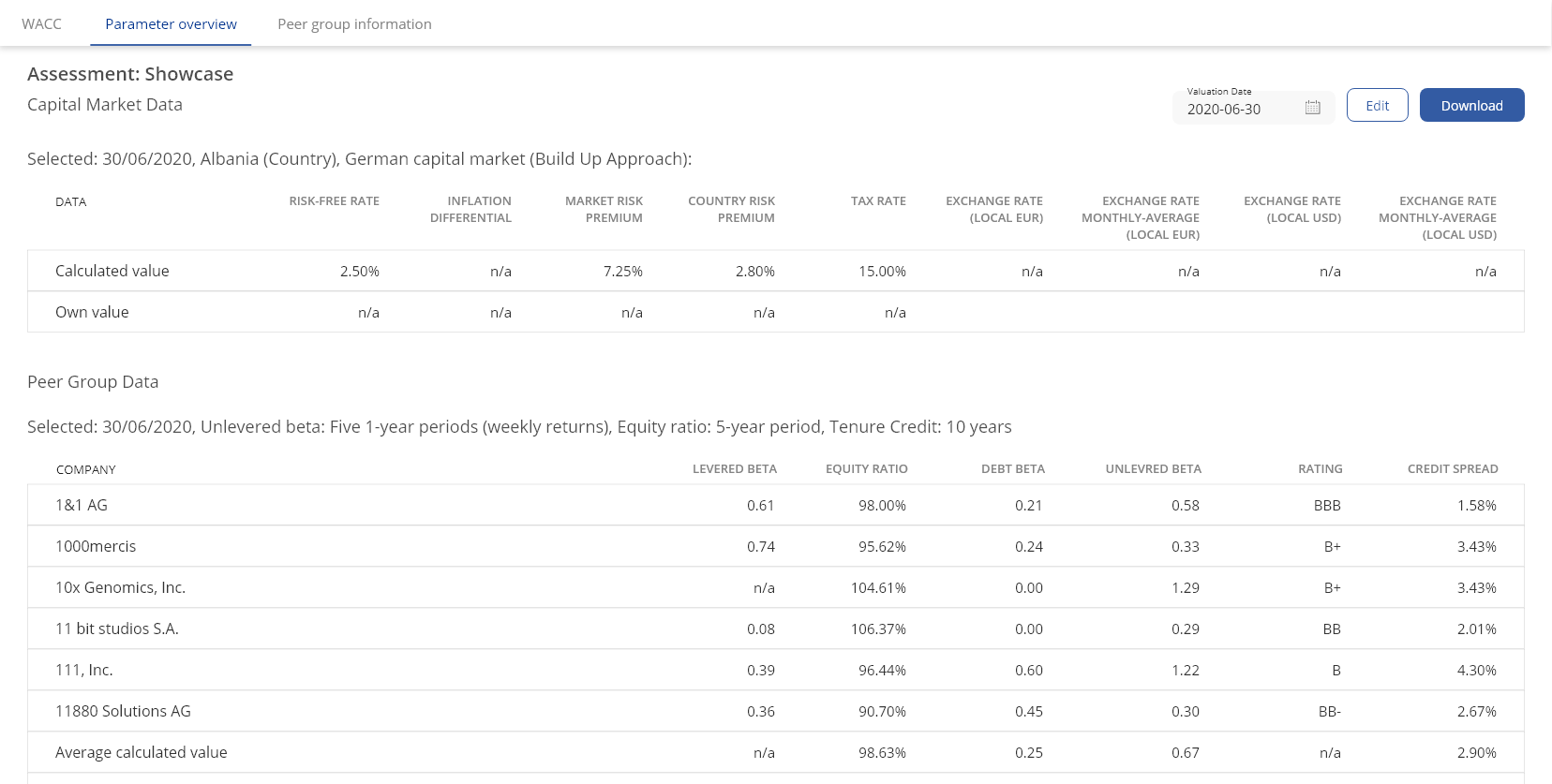

Choosing the appropriate beta factor for calculating the individual cost of capital depends on the specific characteristics of a company. Industry betas offer a simplified way to evaluate company specific risks by using industry risk. A beta higher than 1 indicates that the industry is subject to higher volatility than the market, whereas a beta less than 1 indicates a lower volatility compared to the market. When using the Capital Asset Pricing Model (CAPM) to calculate the cost of equity, one can take the industry beta as a simplified starting point and then adjust it based on company-specifics factors such as gearing and tax rates. The KPMG Valuation Data Source provides various options for determining the unlevered beta factors:

- Raw vs. Adjusted Beta: The "Raw Beta" is derived directly from historical share price data. For a more accurate representation of long-term company trends, the raw beta can be adjusted to an "adjusted beta".

- Certain vs. uncertain tax shields: Tax shields represent the tax benefits of debt financing. The degree of risk of a tax shield depends on the knowledge of future debt. To simplify matters, certain tax shields are often assumed. Generally, however, the future level of debt is uncertain and therefore mostly the tax shields are uncertain.

- Consideration or non-consideration of a debt beta: Incorporating a "debt beta" allows for the inclusion of operational company risk by lenders.

- Different regression periods: The chosen regression period for estimating the beta can affect the stability and accuracy of the result. A shorter period may increase the volatility of the beta factor, but often also incorporates more recent information. Longer regression periods offer a more stable estimate but take less current information into account.

You can calculate both the cost of equity and the cost of debt in addition to the weighted average cost of capital. The weighted average cost of capital (WACC) is vital for determining the value of a company, particularly for the purposes of impairment testing. However, the process of gathering all relevant parameters often requires time-consuming research and data preparation.

Deriving the cost of capital for your company does not have to be complicated. The KPMG Valuation Data Source streamlines this task by furnishing a comprehensive overview of all essential cost of capital parameters, including betas and credit spreads. Through the streamlined process user can swiftly calculate their WACC, cost of equity, and cost of debt, each of which are also relevant for determining the Incremental Borrowing Rate (IBR).

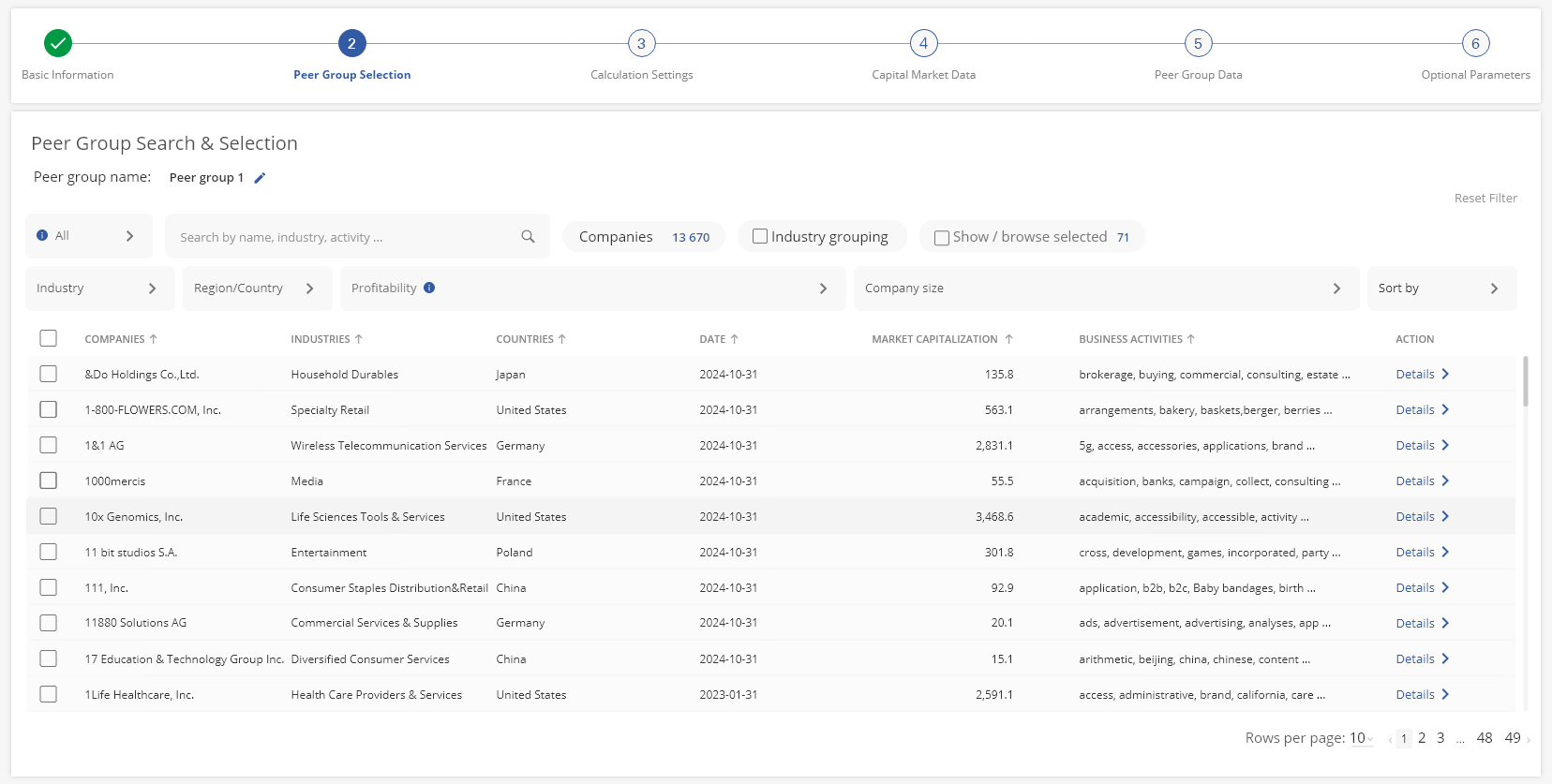

Creating the peer group is a straightforward process within the KPMG Valuation Data Source. To initiate the WACC calculation, users select the preferred reporting date and the desired country, specify the currency, and define the peer group tailored to their requirements. Identifying suitable peer companies is facilitated through the integration of precise search filter functions. Users can employ a variety of filter options based on industry, region or profitability metrics such as margins or growth rates, so the crafted peer group aligns with company specific characteristics and objectives.

For added flexibility, users have the option to incorporate their own values into the cost of capital derivation, overriding the data calculated by KPMG if desired. Our monthly updated database encompasses cost of capital parameters from over 150 countries and 17,500 companies worldwide, with reference dates spanning from 2011 to the present day.

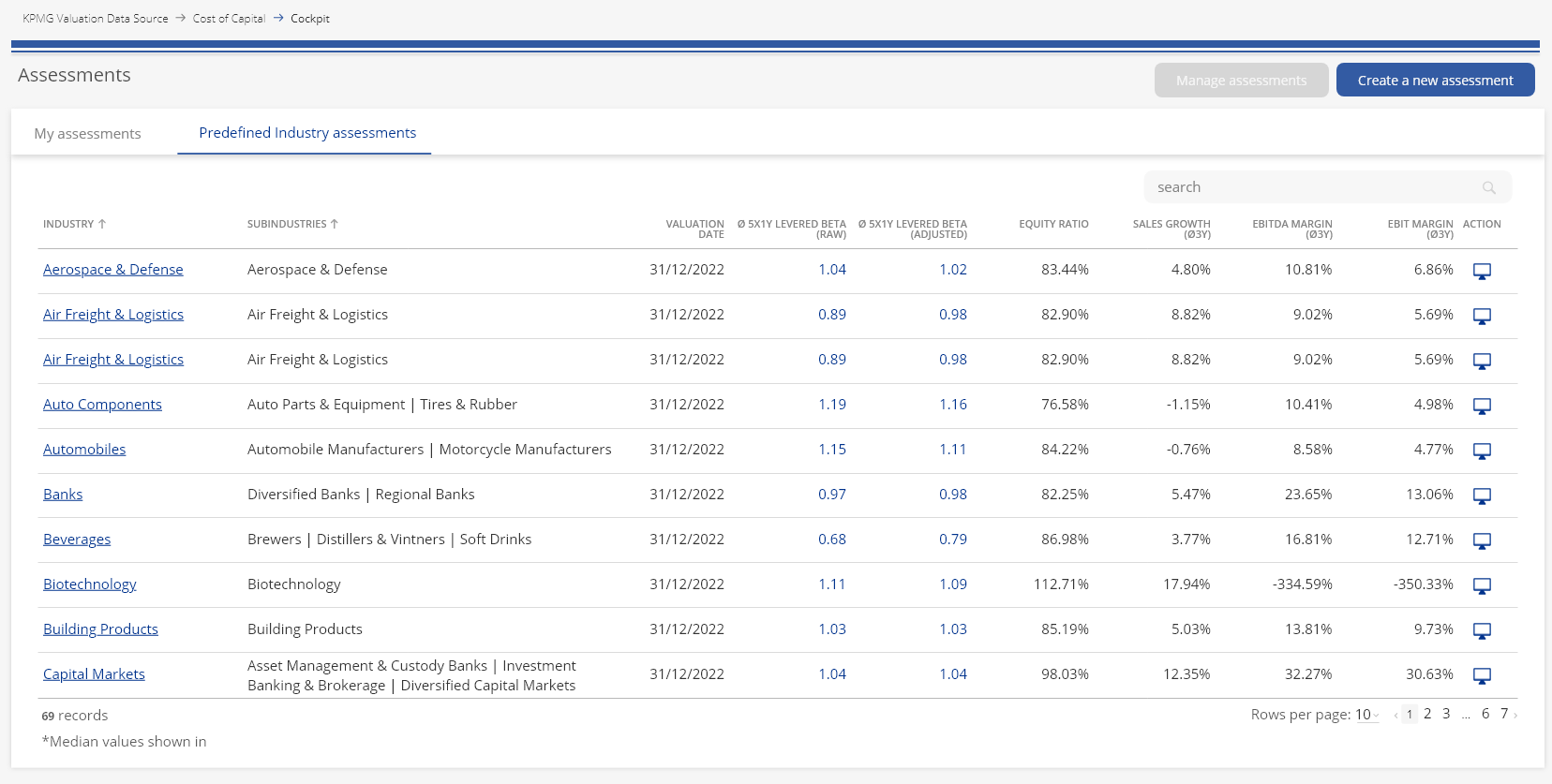

Certainly, it is also feasible to calculate an initial weighted average cost of capital prior to creating an individual peer group. Users have the option to obtain an initial indication of the WACC by accessing monthly updated sector betas and credit spreads from over 70 sectors.

This current sector-specific data provides a valuable starting point, allowing users to gauge the WACC before delving into the peer group creation process. Moreover, the sector data can be easily customized to suit specific settings, supplemented with other desired peer companies, or adjusted for outliers as needed with just a few clicks.

Notably, all entries are automatically saved. This enables users to update WACC calculations for different peer groups to the current reporting date simultaneously with minimal effort, ensuring accuracy and efficiency.

Once calculations and peer groups are created, they can be easily accessed, edited and shared with other users within the platform. This function facilitates collaborative efforts, allowing teams to further refine and work on the results together.

In the final stage, the refined results can be conveniently downloaded as Excel or PDF files, making them suitable for various purposes such as company valuation and the discounted cash flow (DCF) method. If required, the exported results can also be forwarded to auditors along with the documentation for the annual audit process. This flexibility enables users to access their individual cost of capital derivation from anywhere and at any time through the interactive dashboard, empowering efficient decision-making across teams and locations.

.webp?sfvrsn=50f0e173_2/logo-aurantia-AD-kompakt-rgb-(ausgeschnitten).png)