References:

Impairment test & valuation of investments

In just a few steps, the tool guides the user swiftly and reliably through a structured analysis process: from the integrated derivation of cost of capital to automated reporting. All calculations are based on the requirements of current standards, eliminating the need for time-consuming maintenance of Excel valuation models. The tool can be customized to your specific needs, and our valuation experts can additionally support the analysis process.

PRODUCT PRESENTATION

Request a demo appointment now

All advantages at a glance

Collaborative working

Project-based collaboration with multiple team members on a digital platformIntegrated cost of capital

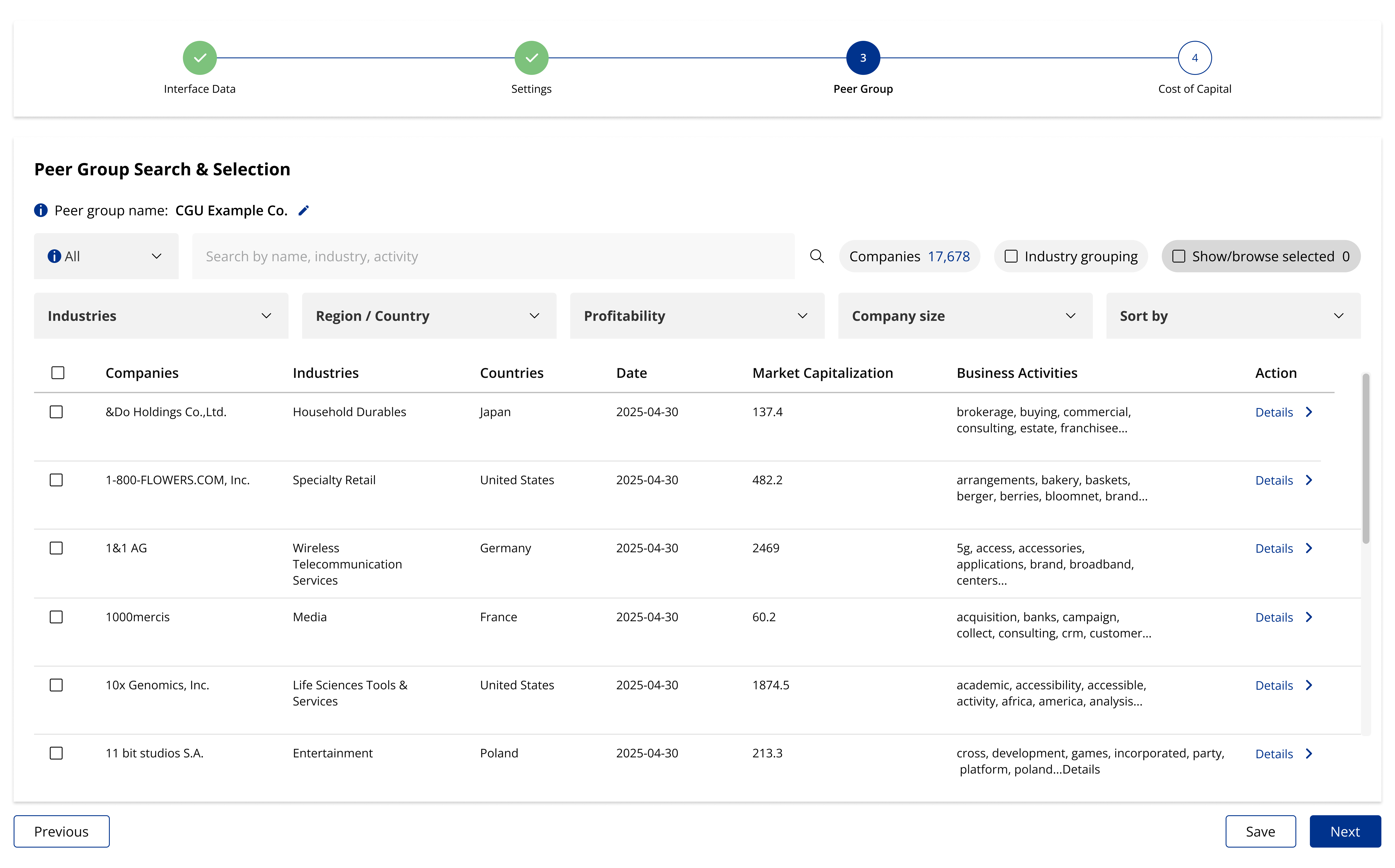

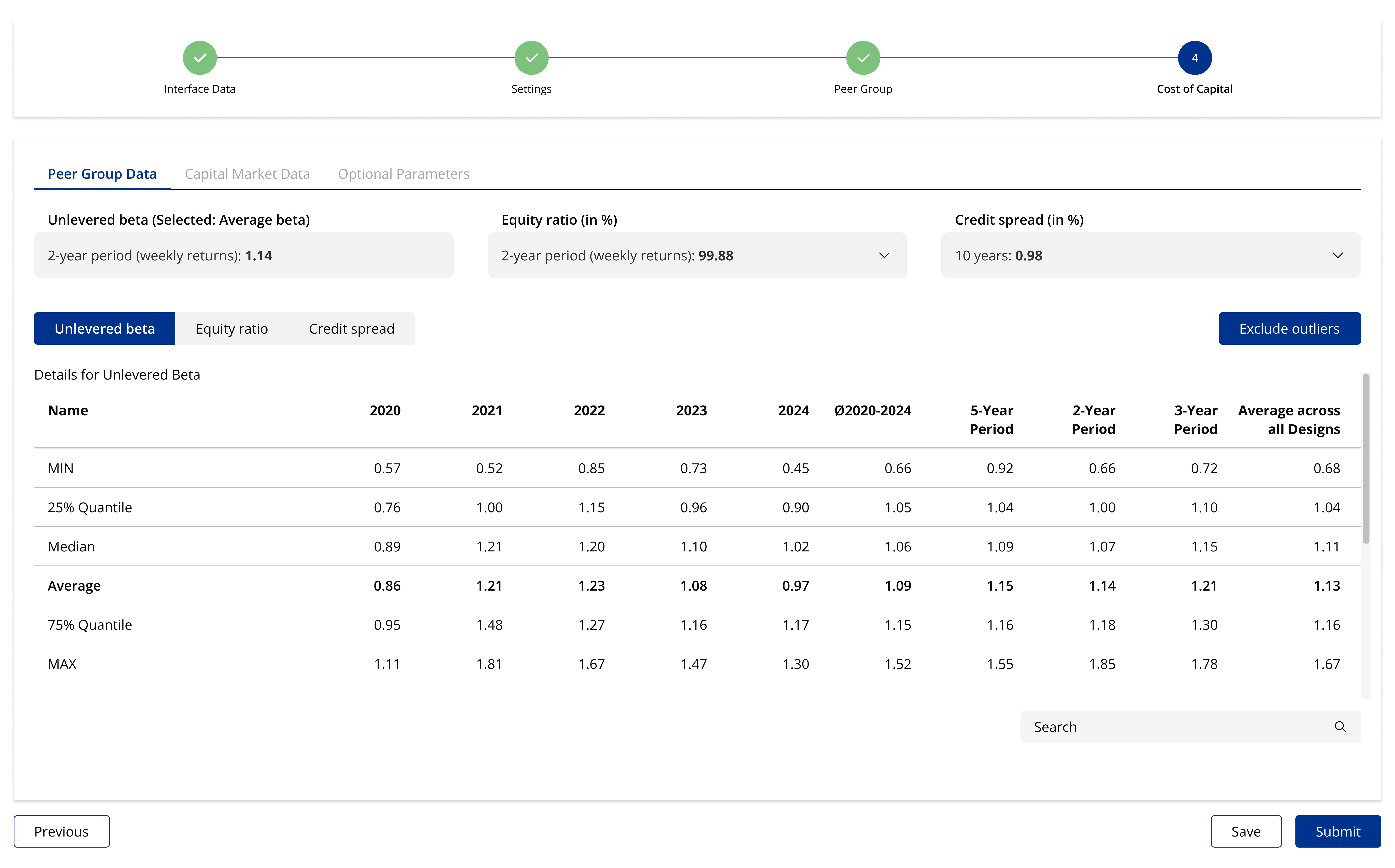

Cost of capital derivation based on monthly updated and quality-assured data, incl. over 17,500 peer companiesTransparent process

Intuitive workflow with flexible adjustments and a clear result presentation ensure transparencyEfficient analyses

Perform impairment tests in just a few steps with integrated data upload and automated documentationCompliance with standards

Reliable results through a quality-assured process in line with latest regulatory standardsFrequently Asked Questions

KPMG Impairment Test is a web-based solution for the efficient and precise performance of impairment tests in accordance with German (HGB) and international accounting standards (IFRS). The digital tool enables users to perform both a goodwill or asset impairment test in accordance with IAS 36 and an investment valuation in accordance with IDW RS HFA 10 standards. The quality of the data and calculations are ensured by our KPMG valuation experts, and they meet the requirements of the current standards.

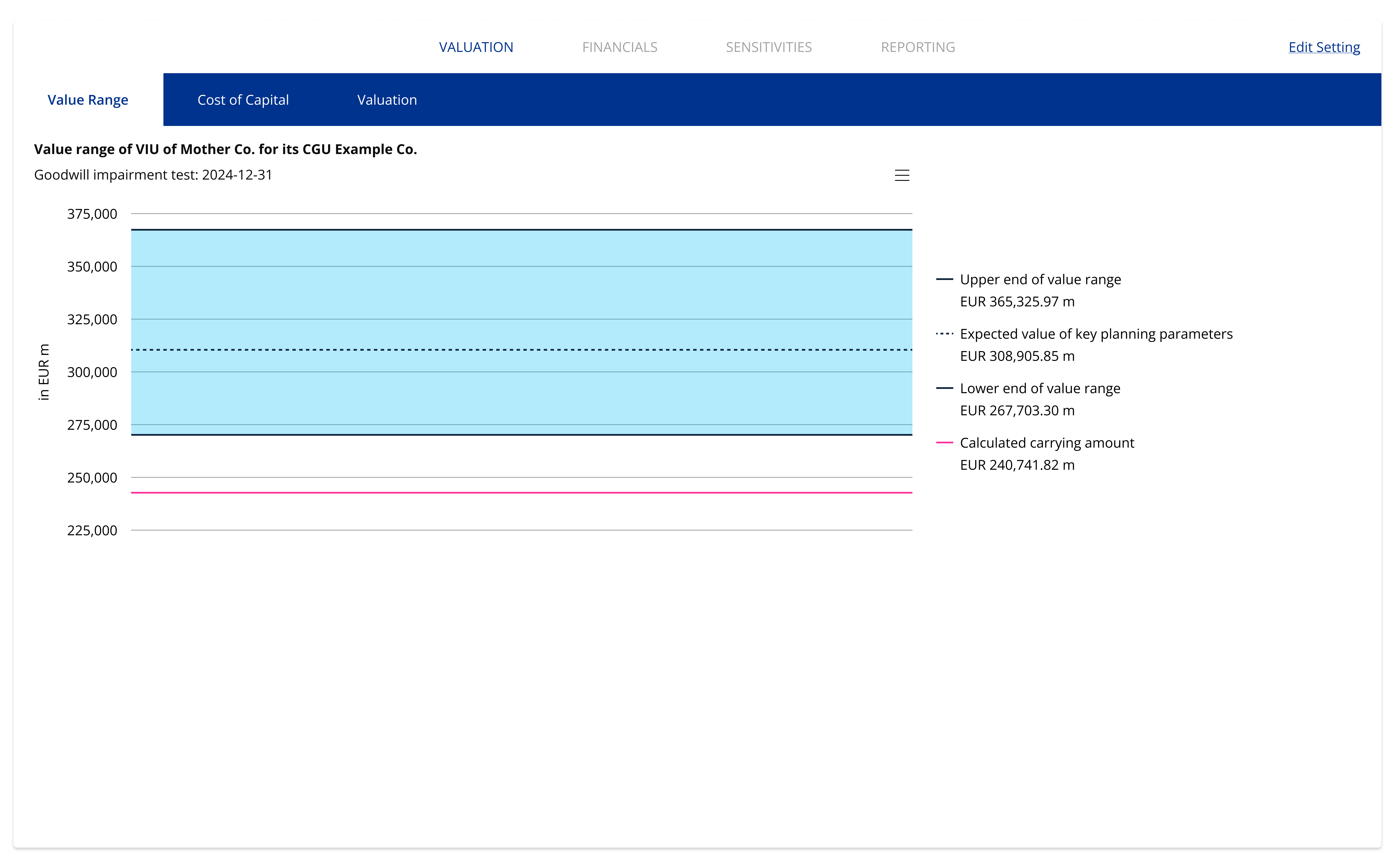

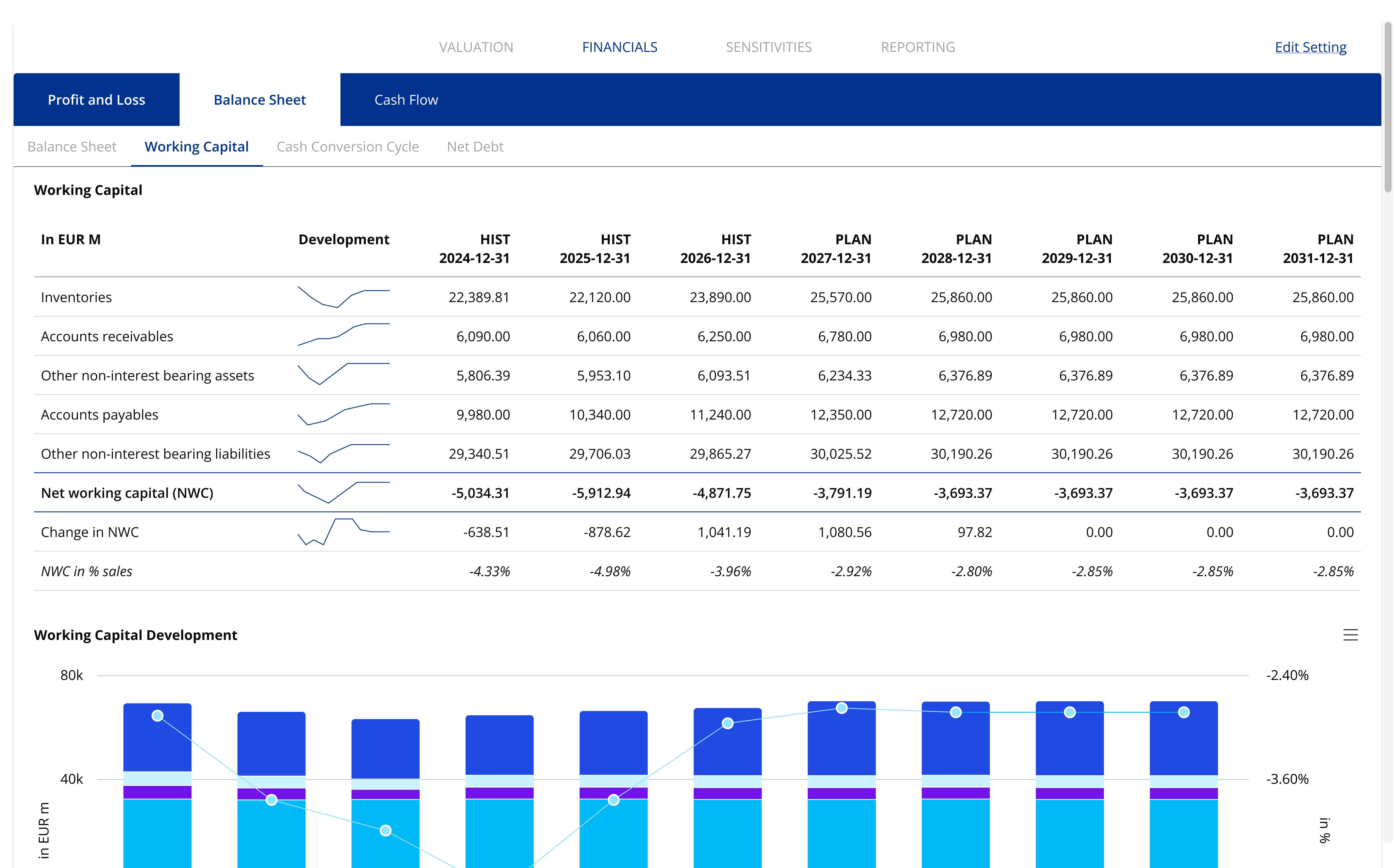

With a structured and user-friendly interface, KPMG Impairment Test enables the efficient and standardized performance of impairment tests in just five clear process steps. The tool guides you in a targeted manner from data upload to impairment analysis and automated reporting. Thanks to the Excel template provided, the business plan can be loaded directly into the tool via an upload process. With the integrated capital cost derivation, companies can incorporate their current capital cost parameters into their analysis results from a selection of over 17,500 peer group companies. In the final step, an automated report based on the selected calculation and parameter settings is prepared, ready to be forwarded to the auditor.

To ensure quality-assured performance of the impairment test, the tool has extensive analysis options in accordance with KPMG valuation standards. Thanks to the integrated corporate planning, users can quickly identify. To increase the quality of results, the development of various input parameters can be tracked in further comprehensive financial analyses. Sensitivity analyses visualize the effects of various planning assumptions in tables and diagrams. The provision of the three reconciled cash flow approaches (free cash flow, total cash flow and flow-to-equity) also ensures a quality-assured calculation.

Creating a report for the auditor that meets the requirements can be time-consuming. With the integrated reporting function, KPMG Impairment Test offers automated and at the same time customizable documentation of results for the respective assessment. This can be downloaded in conjunction with the detailed documentation in PowerPoint or Excel format and forwarded to the auditor. The integrated reporting function not only saves time when creating the required documentation, the ready-made report structure and detailed presentation also simplifies communication of the results to the auditor

Use of the digital tool is not permitted for KPMG audit clients.

.webp?sfvrsn=50f0e173_2/logo-aurantia-AD-kompakt-rgb-(ausgeschnitten).png)