New Features

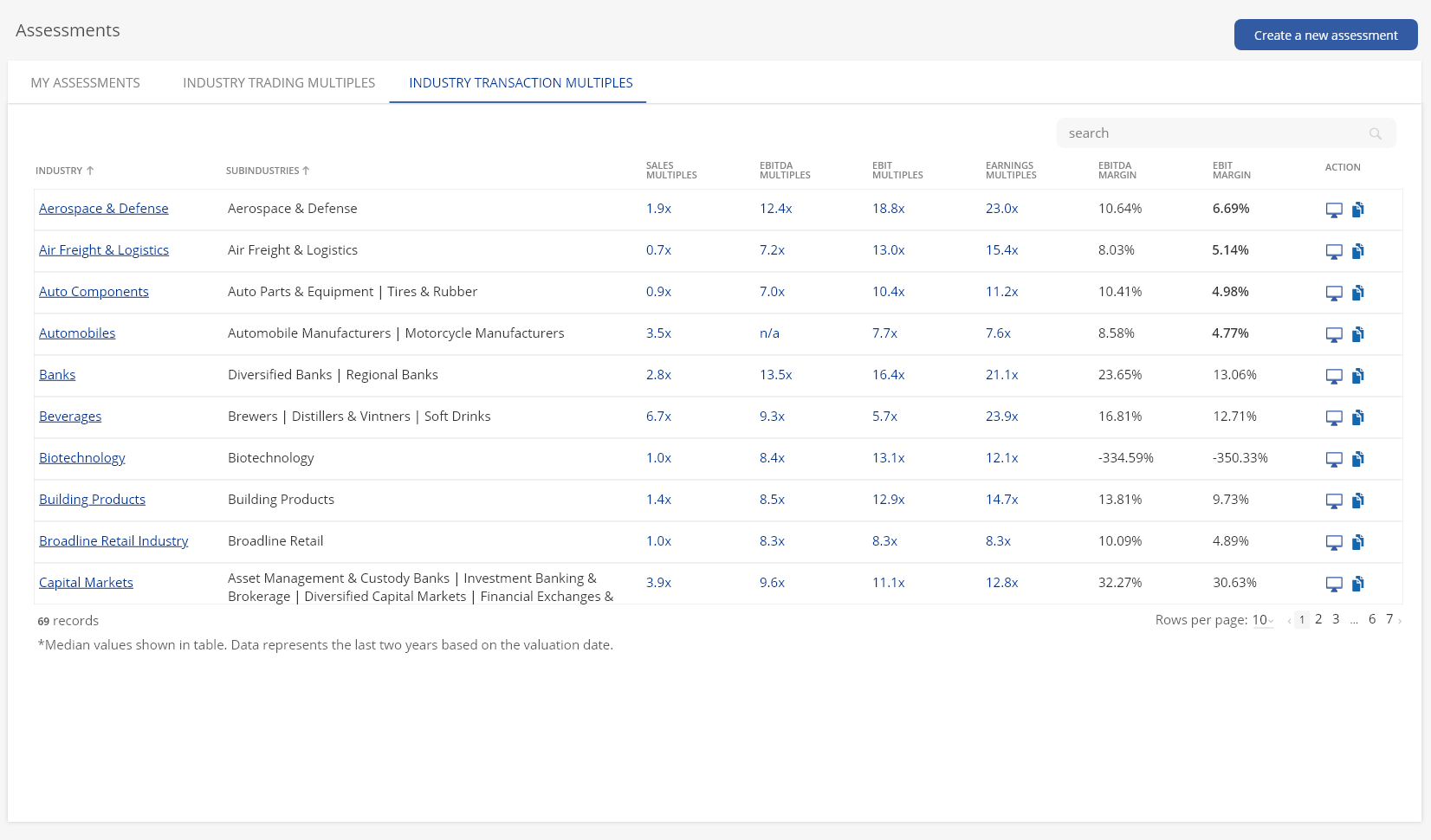

Our database has been updated with transaction multiples recently.

References:

Trade and transaction multiples for:

- Sales Multiples

- EBITDA Multiples

- EBIT Multiples

- Earnings multiples

- Book Value to Market Value of Equity Multiples

Pricing with foresight

KPMG Multiples – test demo for free now

Available Multiples

All benefits at a glance

Relevant

The most important trading multiples in one place.

Reliable

All data is derived based on consistent KPMG valuation standards.

Up to date

Monthly updates ensure that the data is up to date.Concise

All important values at your fingertips at a glance.Practical

Results can be exported to Excel for further processing.

Frequently Asked Questions

What are trading multiples?

A multiple is a financial metric derived by dividing the entity or equity value of a company by a financial KPI (e.g., the equity value divided by the net income results in a scope of a net income multiple). A multiple can be used to estimate the price of a comparable company based on the underlying KPI. Hence, if someone is interested in a market price of a company, peer group multiples can serve as an indication of how much a typified investor would be willing to pay for a company. In order to derive an indicative range for the market price of the valuation object, the resulting multiple range can be applied to the respective KPI. The selection of appropriate multiples for valuation depends on the nature of the business of the valuation object. Our App offers Sales Trading Multiples, EBITDA Trading Multiples, EBIT Trading Multiples, Earnings Trading Multiples as well as Book Value to Market Value of Equity Trading Multiples (book-to-market ratio).

Are trading multiples also valid for the financial industry?

Due to the special characteristics of companies operating in the financial industry (such as high leverage, high dependency on the interest level, etc.), net debt, the enterprise value and thus the corresponding trading multiples may be of limited relevance.

What is the advantage of using Trading Multiples vs. Transaction Multiples?

Trading multiples can be calculated for any time in history where a company was publicly listed. They can change from one day to the next, as price points become available and fluctuate daily. In contrast, transaction multiples can only be calculated for the particular date of a transaction, as no other data points are available. Also, transaction multiples aren’t always publicly available.

Does the tool also contain transaction multiples?

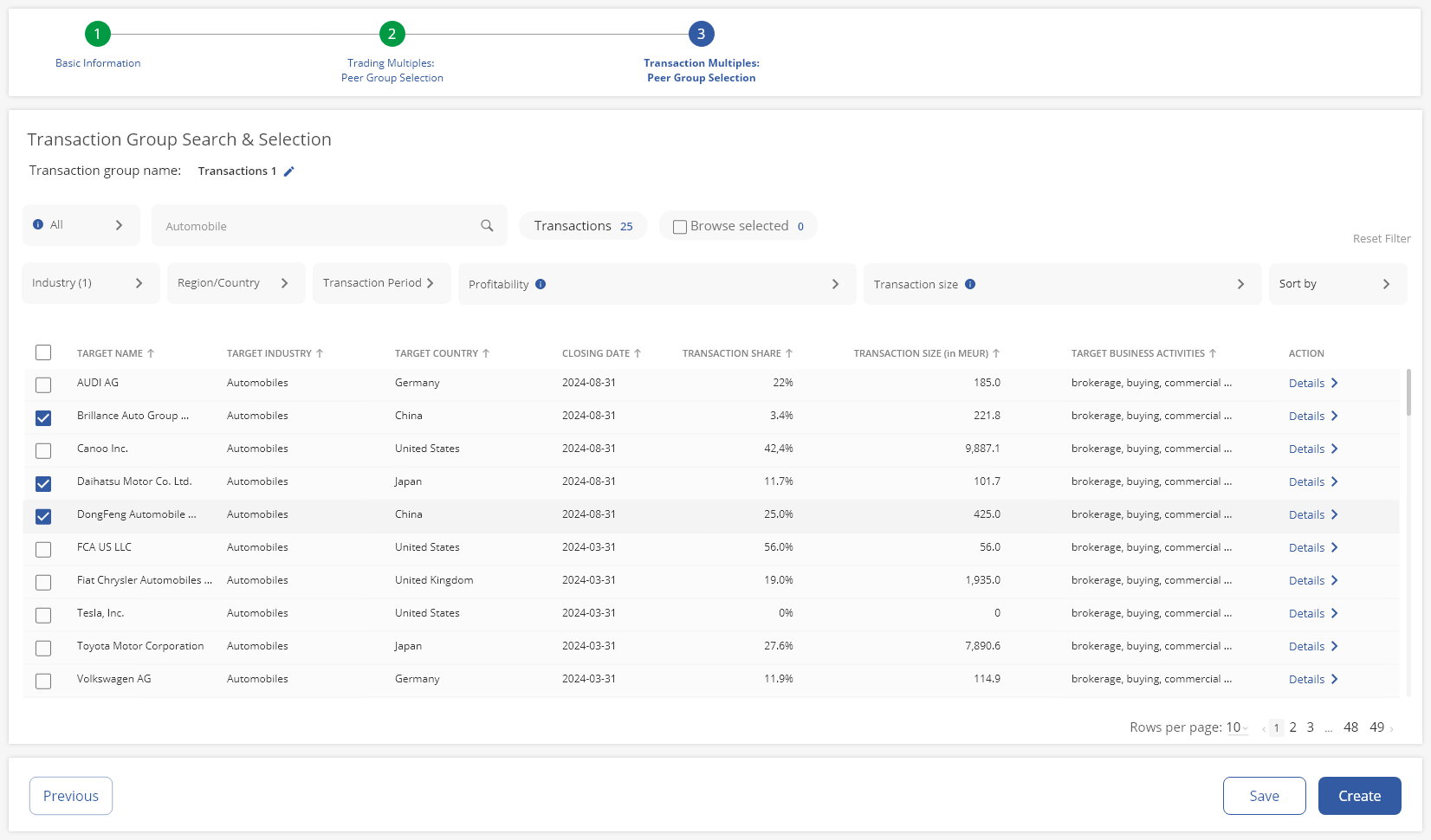

Yes, the extensive database of the KPMG Multiples App contains monthly updated trading multiples from more than 17,500 companies worldwide as well as transaction multiples from over 55,000 transactions. Users can identify a suitable peer group of comparable companies or transactions using customized filter options such as industry, region and profitability filters (e.g. margins or growth). Predefined industry multiples serve as an initial orientation for peer group creation. Based on the peer group-specific multiples provided, the individual company value is then calculated, whereby both the entity value and the equity value are shown.

Which multiples can I use for the company valuation?

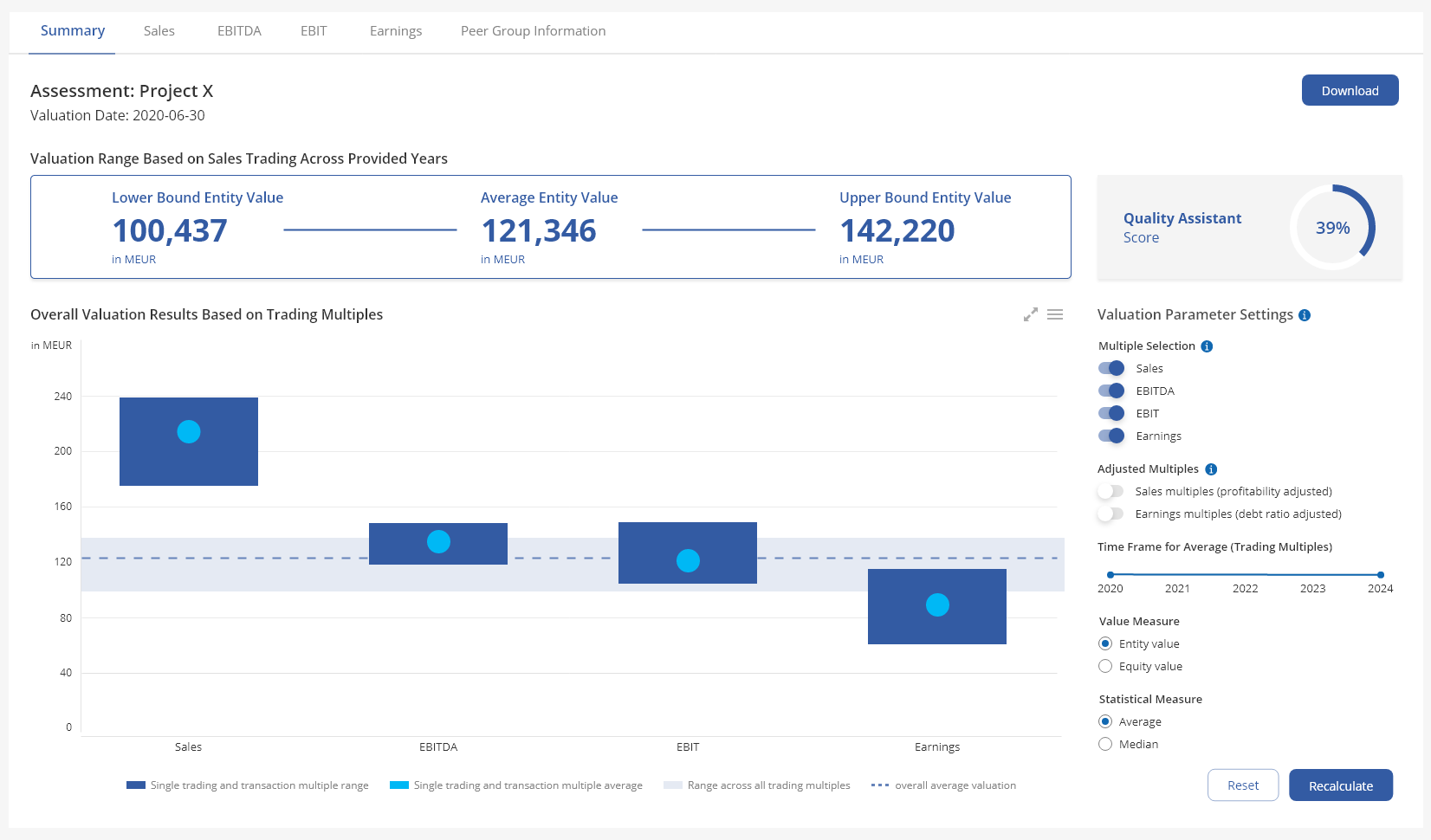

In the KPMG Multiples App, users can flexibly determine which multiples are used to calculate the company value: Sales, EBITDA, EBIT and/or earnings multiples. With the help of these quality-assured multiples and the methodological approach, the solution helps to obtain a reliable valuation result.

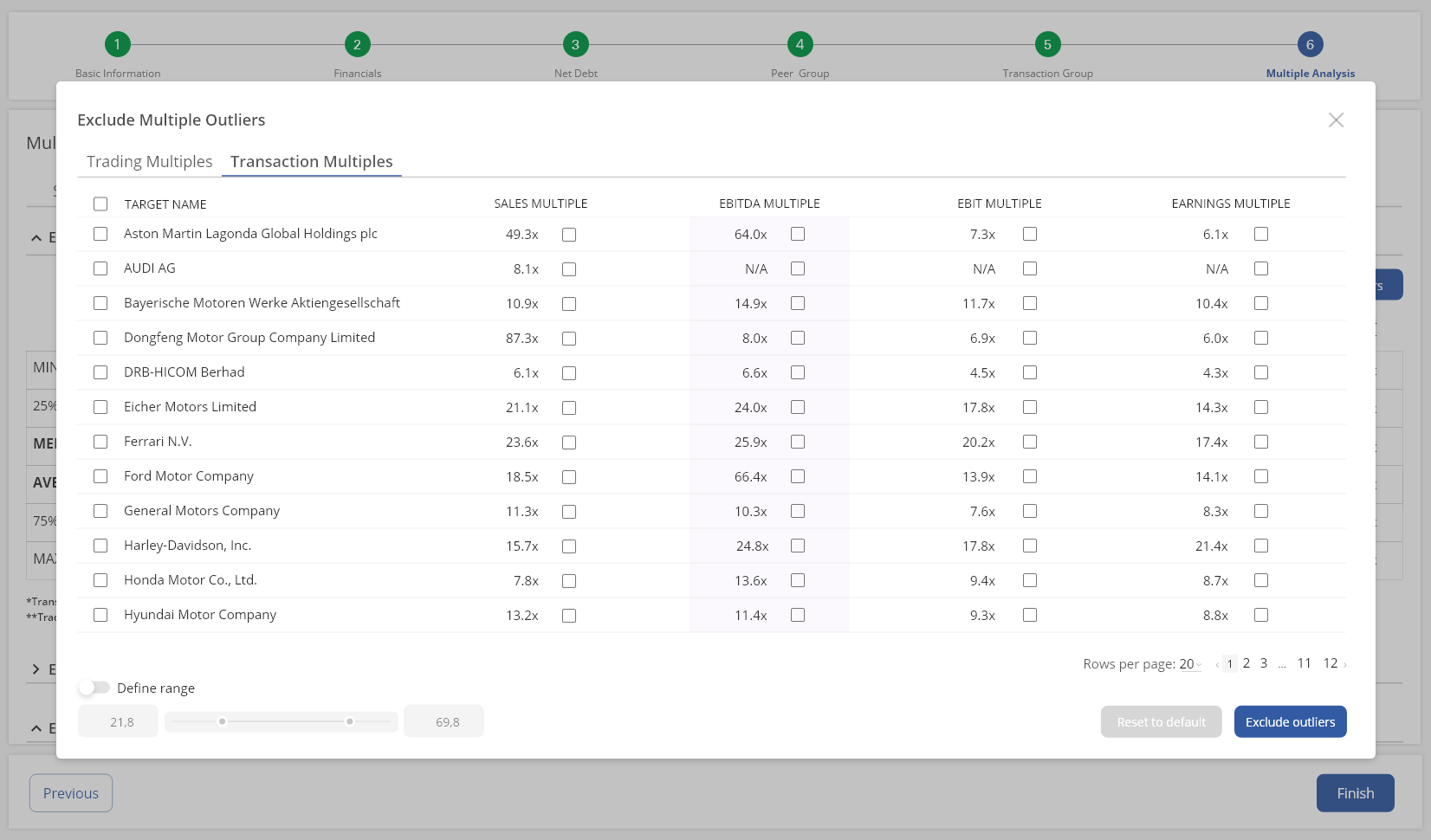

Can I adjust the result of the multiple valuation for outliers?

The multiples to be included in the evaluation can be defined according to individual ranges or adjusted for outliers if required. For additional validation, the tool provides the number of underlying analyst estimates for determining the multiples. With the Excel download function, users can export both the valuation results and the raw data and then process them as required.

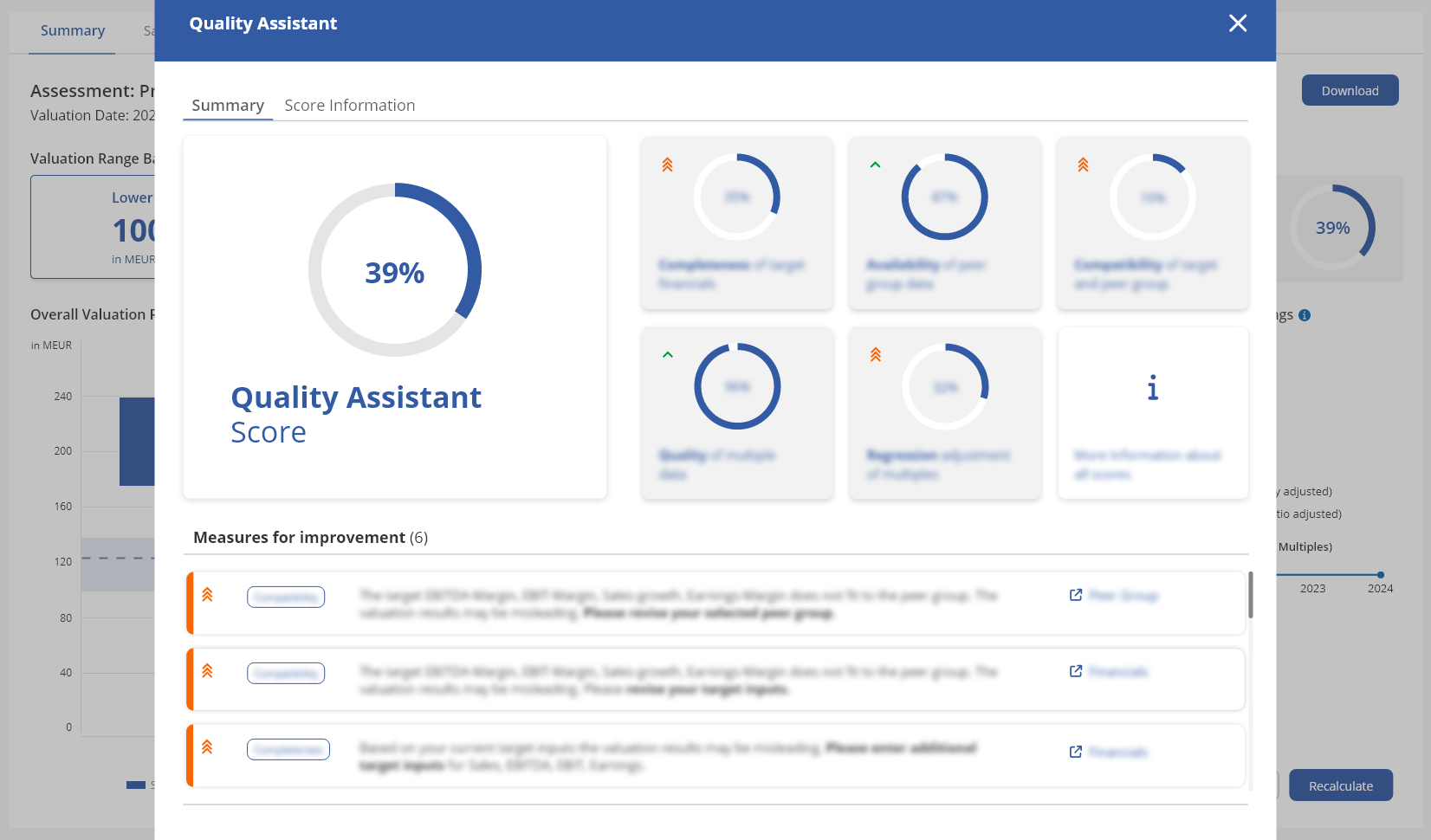

How is the quality of the multiples and the valuation result ensured?

The KPMG Multiples App ensures the quality of the multiples by comprehensively evaluating and cleansing the data. The transparent evaluation process and the comprehensible presentation of results enable the evaluation result to be derived efficiently in five steps. This includes the key financial figures, current multiples and the generation of valuation results at the touch of a button. The structured presentation of data and calculations as well as the clear dashboard with KPIs and value range ensure transparent and comprehensible documentation of the underlying data and methods. The Quality Assistant also supports users in analyzing the selected multiples and provides a guide to increase the quality of the valuation result.

.webp?sfvrsn=50f0e173_2/logo-aurantia-AD-kompakt-rgb-(ausgeschnitten).png)