References:

Transparency for clear transaction decisions

In the initial phase of a company acquisition, it is important for every potential buyer to be able to estimate the effects on the balance sheet and future profitability. This enables a profound determination and analysis of the purchase price based on a quantitative and qualitative analysis of the transaction and its effects Next to the challenge posed by the short timeframe when conducting a Pre-Deal PPA, data availability plays a central role in creating a meaningful analysis.

With the KPMG Pre-Deal PPA Solution, possible accounting effects of an acquisition are calculated and visualized in just a few steps. This enables an immediate assessment of the effects of the company acquisition

In order to calculate intangible and tangible assets and liabilities, the online solution uses a KPMG database with relevant evaluation parameters from over 40 industries. The tool thus delivers a valid assessment without the need for time-consuming research into assessment assumptions, s.a. economic or tax useful lives. In addition, your own assumptions can easily be integrated into the calculation and checked for plausibility.

KPMG Pre-Deal PPA – test demo for free now

Use cases

|   |   |   |

All benefits at a glance

Effective

A short input process creates space for analyses and scenario calculations

Simple

Simple execution of Pre-Deal PPA through clear process control

Reliable

The fully integrated calculation model (in the style of IFRS 3) is based on KPMG evaluation standards with the inclusion of PPA benchmark data

Clear

Visualisation of essential PPA effects and relevant evaluation parameters in a dashboard

Practical

The results can be exported in Excel

Additional product information

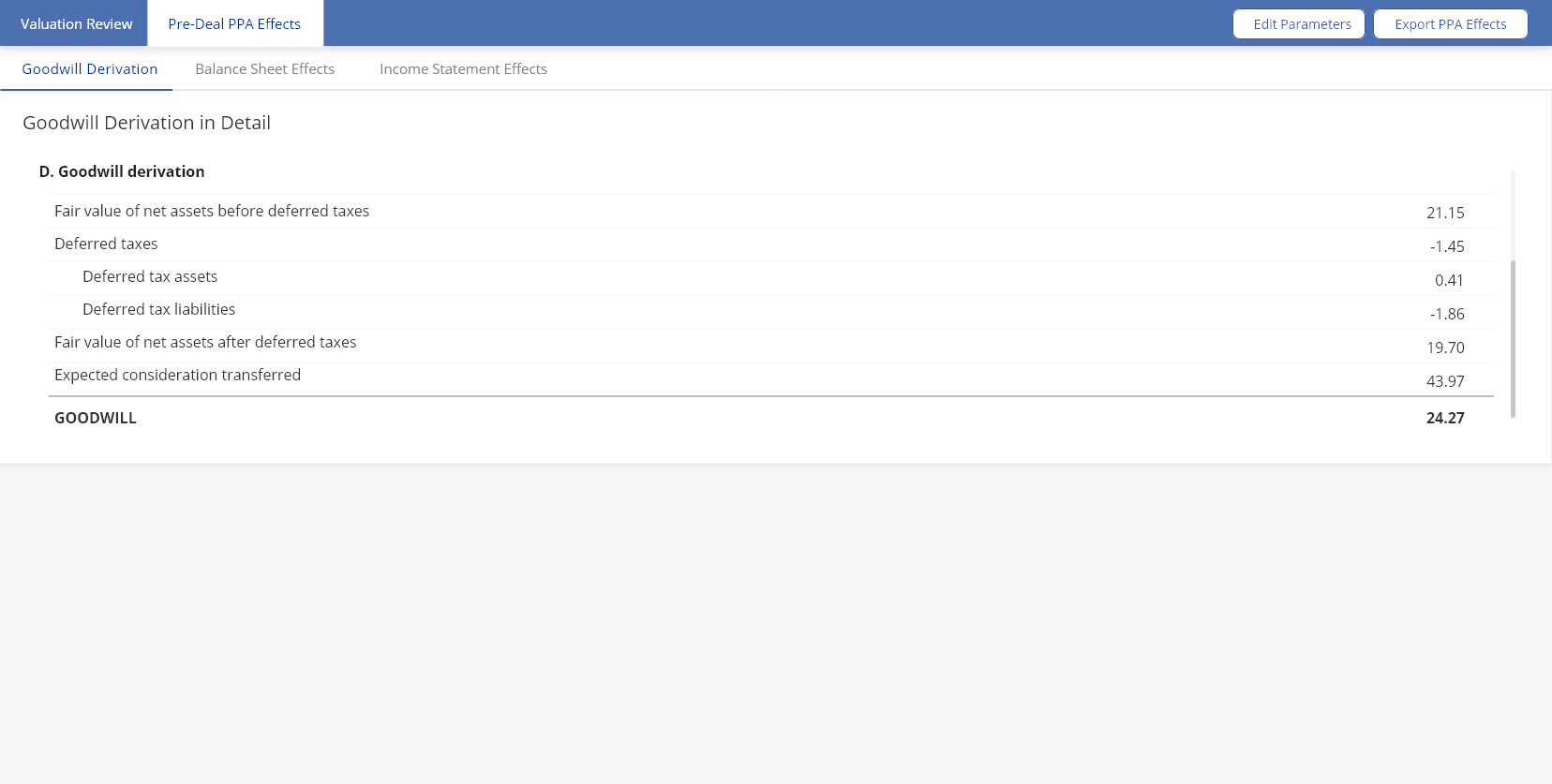

The output scope

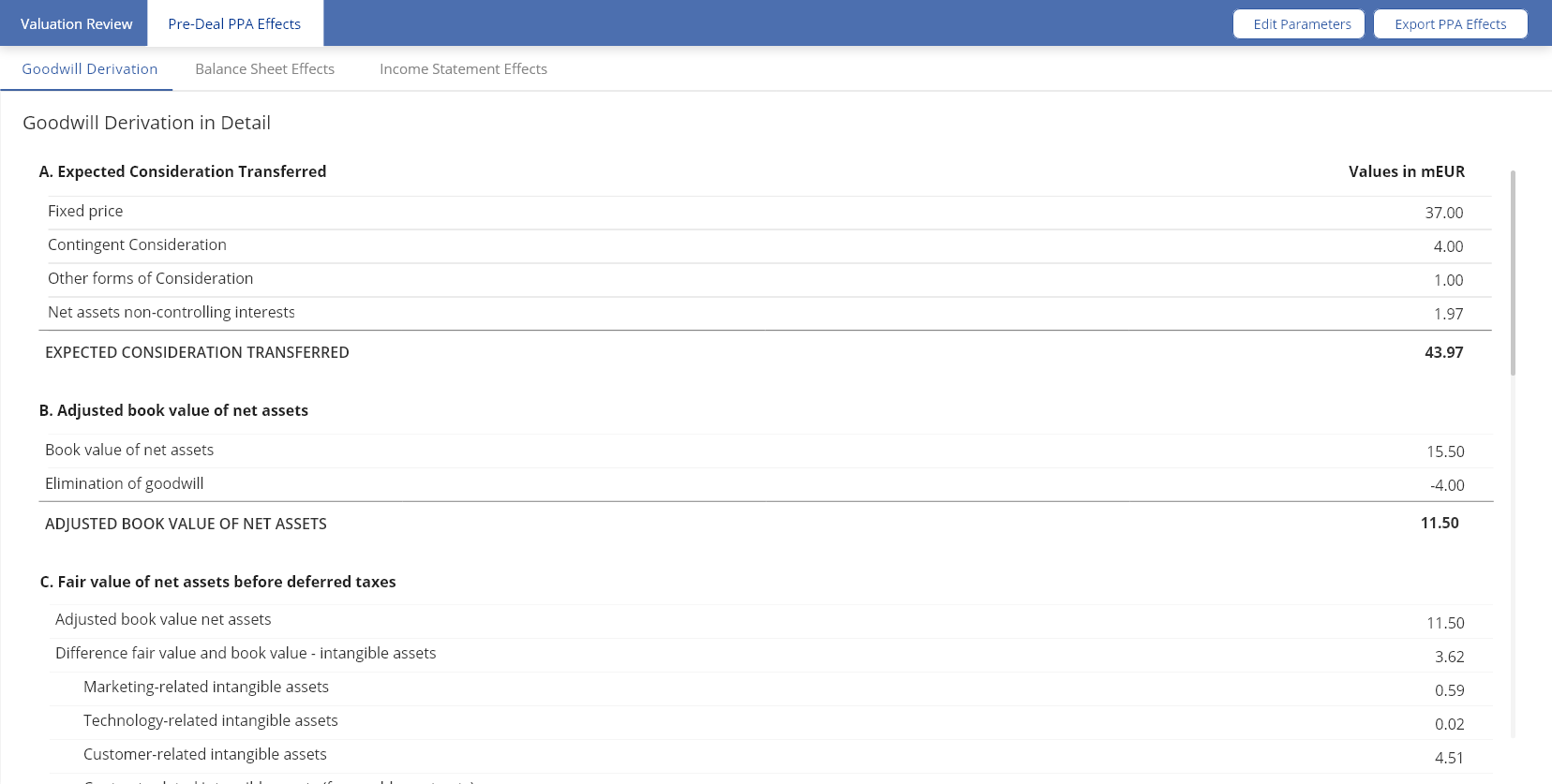

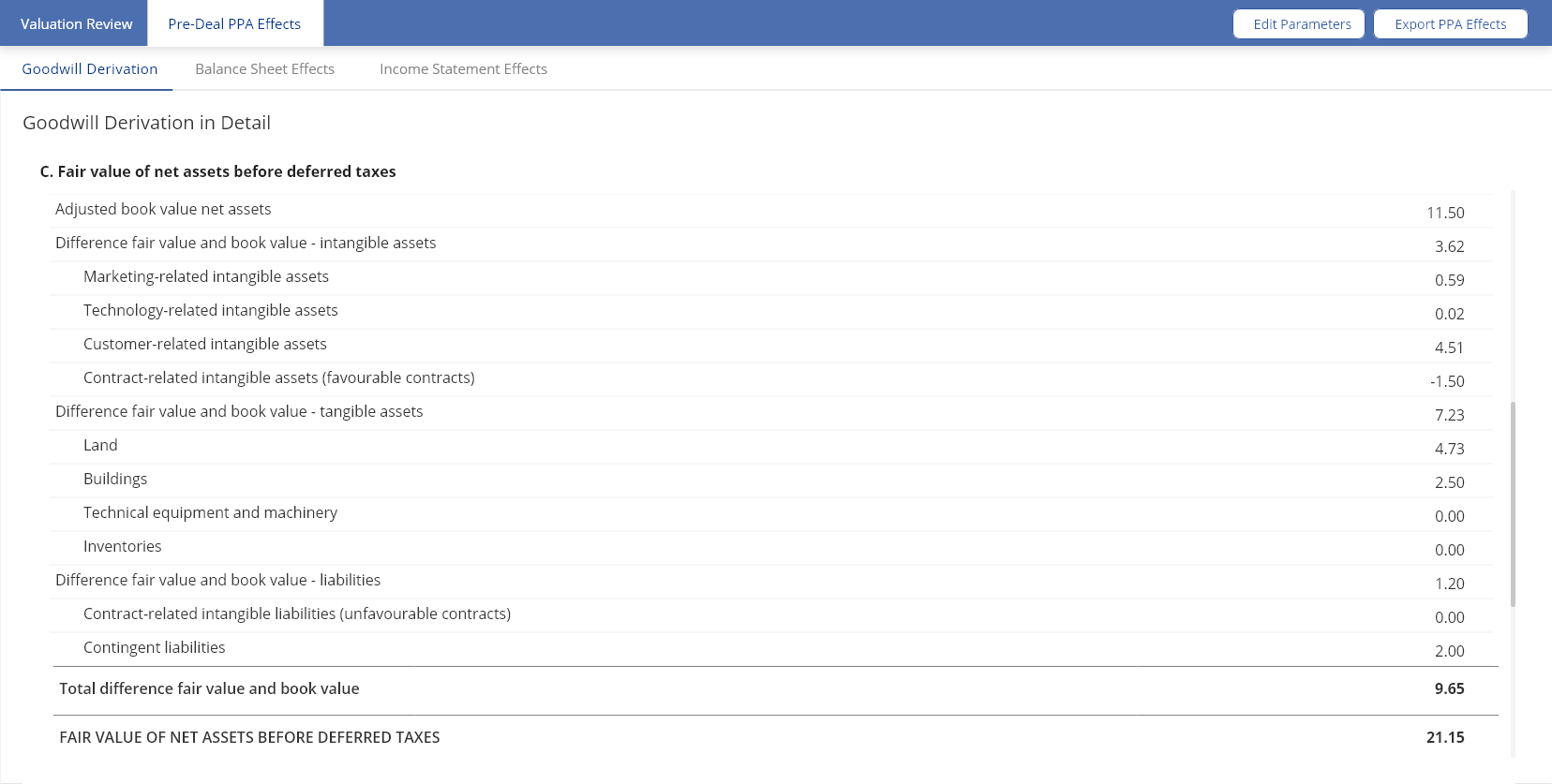

- Values of tangible and intangible assets and liabilities

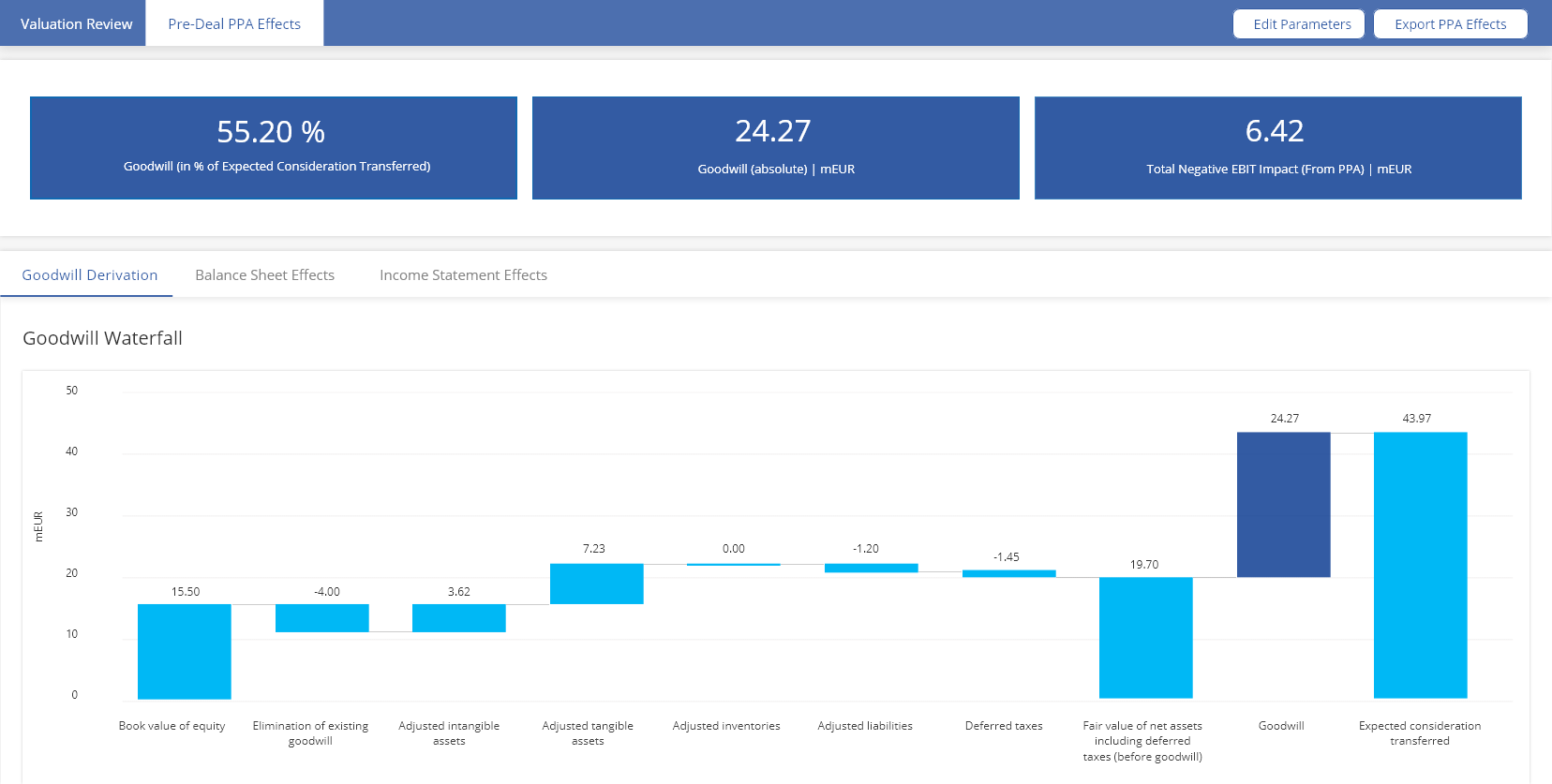

- Derivation of goodwill

- Balance sheet effects resulting from the PPA

- Presentation of impacts on profitability

- Possibility of entering your own assessment assumptions

Product versions at a glance

KPMG Pre-Deal PPA

Self Service

You receive independent access to all of the tool's functions. This enables you to enter the data yourself and view and export the results directly.

KPMG Pre-Deal PPA

Managed Service

In addition to tool access we provide you with a personal advisor as your direct contact regarding setup and data entry. The preliminary results will be presented to you in a personal meeting. You will then receive an executive summary.

KPMG Pre-Deal PPA

Tailored Service

Full implementation of a Pre-Deal PPA using the online solution. In addition to the tool access we provide you with a personal advisor as your direct contact and tailored derivation of relevant valuation parameters. You will receive the results in a detailed report.

Frequently Asked Questions

How is the fair value of intangible assets estimated?

The parameters relevant to the valuation of the intangible assets of the target company are determined based on your individual input and expert estimates. The KPMG Pre-Deal PPA contains expert estimates of parameters for 15 sectors and 40 sub-sectors. Using empirically collected data from previous purchase price allocations, the solution shows PPA benchmarking possibilities for the fair values of the intangible assets and resulting goodwill with sector-specific bandwidths.

Which discount rate should be used for the calculation?

The user has to enter revenues, EBITDA and depreciation/amortization of the target company in the input mask. The entry of one budget year is mandatory. Moreover, there is the option to add data for five further planning years. For periods beyond the entries made by the user, revenues are extrapolated by a country’s expected inflation rate in which the target is located. The last calculated EBITDA-margin is considered as constant and sustainable.

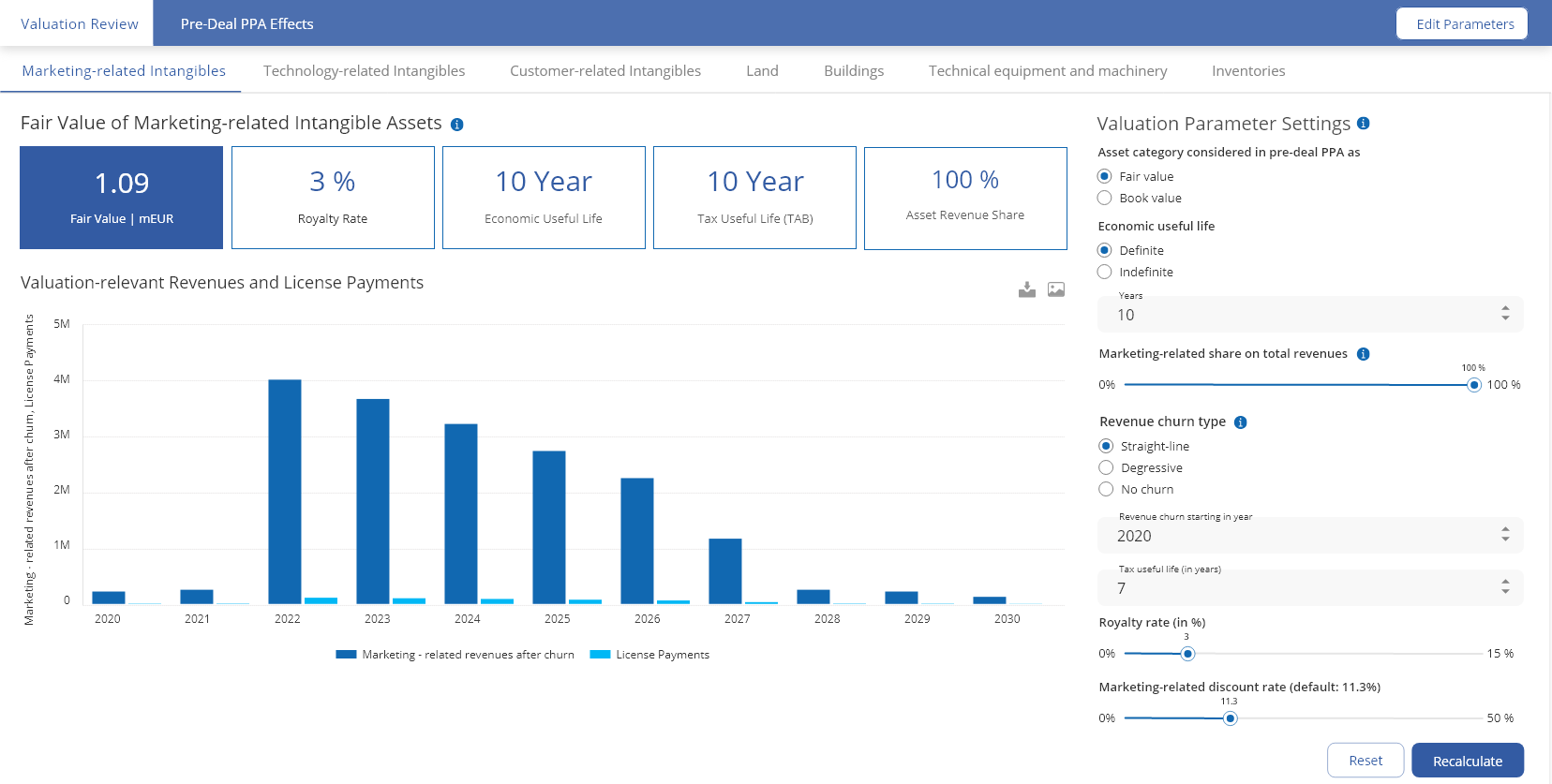

Which valuation methods are used to calculate the fair values of tangible and intangible assets?

The fair value of tangible assets like buildings and land is determined by a step-up or step-down expressed as a percentage of the book value capitalized on the target’s balance sheet. By default, the step-up or step-down in percent is based on the experience of KPMG valuation and industry specialists. The valuation of intangible assets is performed in the course of a portfolio approach and not on an individual asset level. The relief-from-royalty method is used for the valuation of the portfolio of marketing- and technology-related intangibles, where the value of the portfolio is considered as the value of the royalty payments from which the target is relieved due to its ownership of the portfolio of marketing- or technology-related intangible assets. For determining the fair value of customer-related intangible assets, the multi period excess earnings method (“MEEM”) is used. The MEEM method calculates the cash flows based on a detailed forecast of cash inflows and cash outflows that in general are derived from the entered business plan.

.webp?sfvrsn=50f0e173_2/logo-aurantia-AD-kompakt-rgb-(ausgeschnitten).png)