Our offer includes:

- DAC6 training on the key specialist provisions pursuant to the DAC6 Council Directive (EU)

- Interactive e-learning in six modules

- Comprehension questions to check knowledge

- Support in case of technical problems

Demo for free

Please click on the button below and register on Atlas. Your demo will be made available within one business day via myAtlas.

How will you train your employees on DAC6 and the reporting obligations for cross-border tax arrangements?

Staff rotation and the creation of an effective tax CMS according to PS 980 require professional training in all tax processes. Identifying reportable issues is particularly complex in an international business structure. It is necessary to consider all involved units and the staff of the areas concerned. Extensive measures are generally necessary to keep the required expertise up to date. Use KPMG DAC6 Digital Learning to cover these matters in one training course with 6 modules and to efficiently integrate it into your training measures.

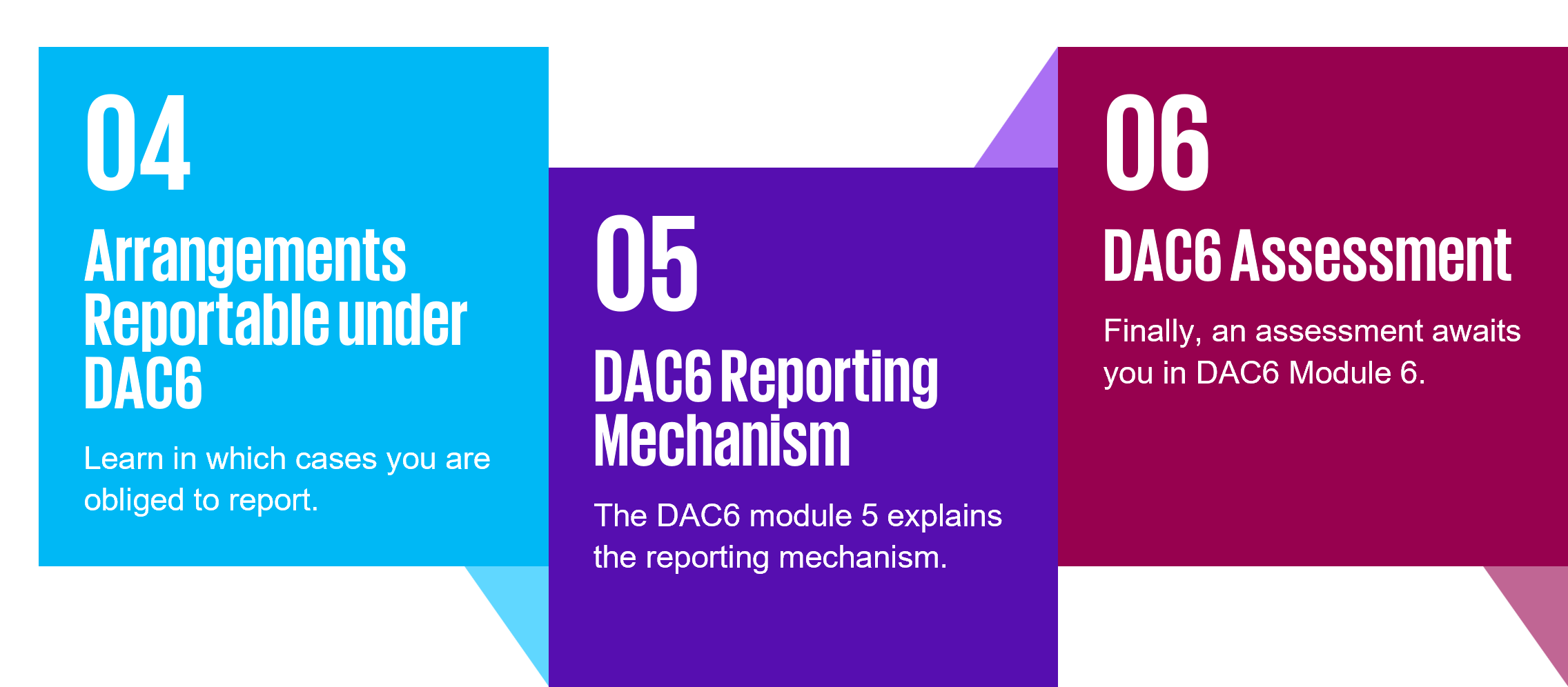

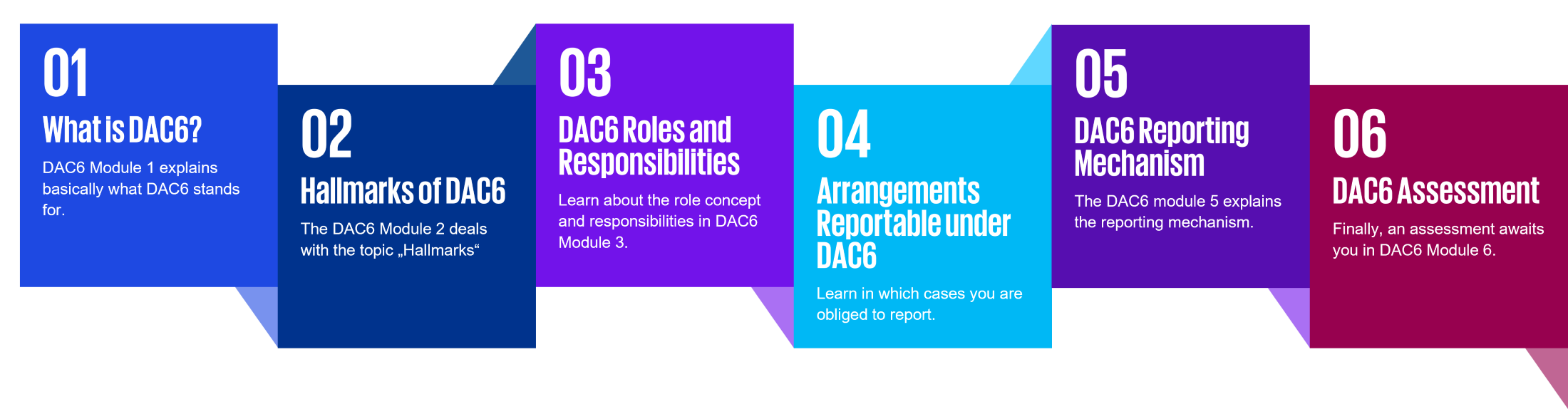

KPMG expertise in 6 interactive learning modules

KPMG DAC6 Digital Learning is divided into six modules covering different focus topics. It is available at any time via myAtlas and can be completed in self-study.

Interesting facts

Further KPMG e-trainings can be found on the KPMG website Virtual learning that is fun. You can find further information on the DAC6 Council Directive on the KPMG website Mandatory disclosure of tax arrangements and DAC 6 management from KPMG.

Questions and answers

Yes, your KPMG contract can give you access to a demo learning management system for this purpose for a limited time. You can then have access to the training for two weeks.

The KPMG DAC6 Digital Learning is available to you online on the KPMG ATLAS platform and can be called up using commonly used browser-compatible devices.

If your company uses its own learning management system (LMS), you will receive a SCORM standard 1.2, which can be integrated into your system (international standard).

Depending on topic, an e-training takes between 25 and 40 minutes and is subdivided into clearly arranging learning units. Learning progress is saved, meaning that an e-training can be suspended at any time and continued at a later point in time.

No.

Would you like to know more?

Simply contact us and we will be happy to answer your individual questions.