Why AI-Powered invoice processing?

Currently, most activities in invoice processing are still carried out manually. This is particularly due to the clarification of frequently occurring exceptional cases ("exception handling") as well as the difficult assignment of purchase order and invoice line items.

On average, nearly 40% of capacities in accounting are tied up in invoice processing. For over two years, our technology has demonstrated in successfully that "Quick-wins" with technology can achieve rapid successes and significant savings. Our goal is to ensure that employees in accounts payable no longer process invoices manually, but rather engage in value-adding activities, for example, in process optimization.

Use the KPMG Lighthouse expertise for your company

From the challenge …

Manual invoice processing

A current challenge for businesses is the manual processing of invoices. This is particularly due to the diversity of information that needs to be identified, such as general ledger accounts, tax codes, cost centers or cost units, as well as approvers and purchase order references.High error rate

The processing of invoices involves a multitude of qualitative, regulatory, and tax requirements. Mistakes in invoices can have significant consequences, such as incorrect deductions of input tax by the tax authorities. Based on experience, only a portion of these requirements can be reliably met in accounting departments or shared service centers.Working in the process

Currently, invoice processing occupies the majority of accounting capacities. Due to cost pressure and existing shortages of skilled workers, these activities are predominantly outsourced to low-wage locations.

… to the solution

Fully automated invoice processing

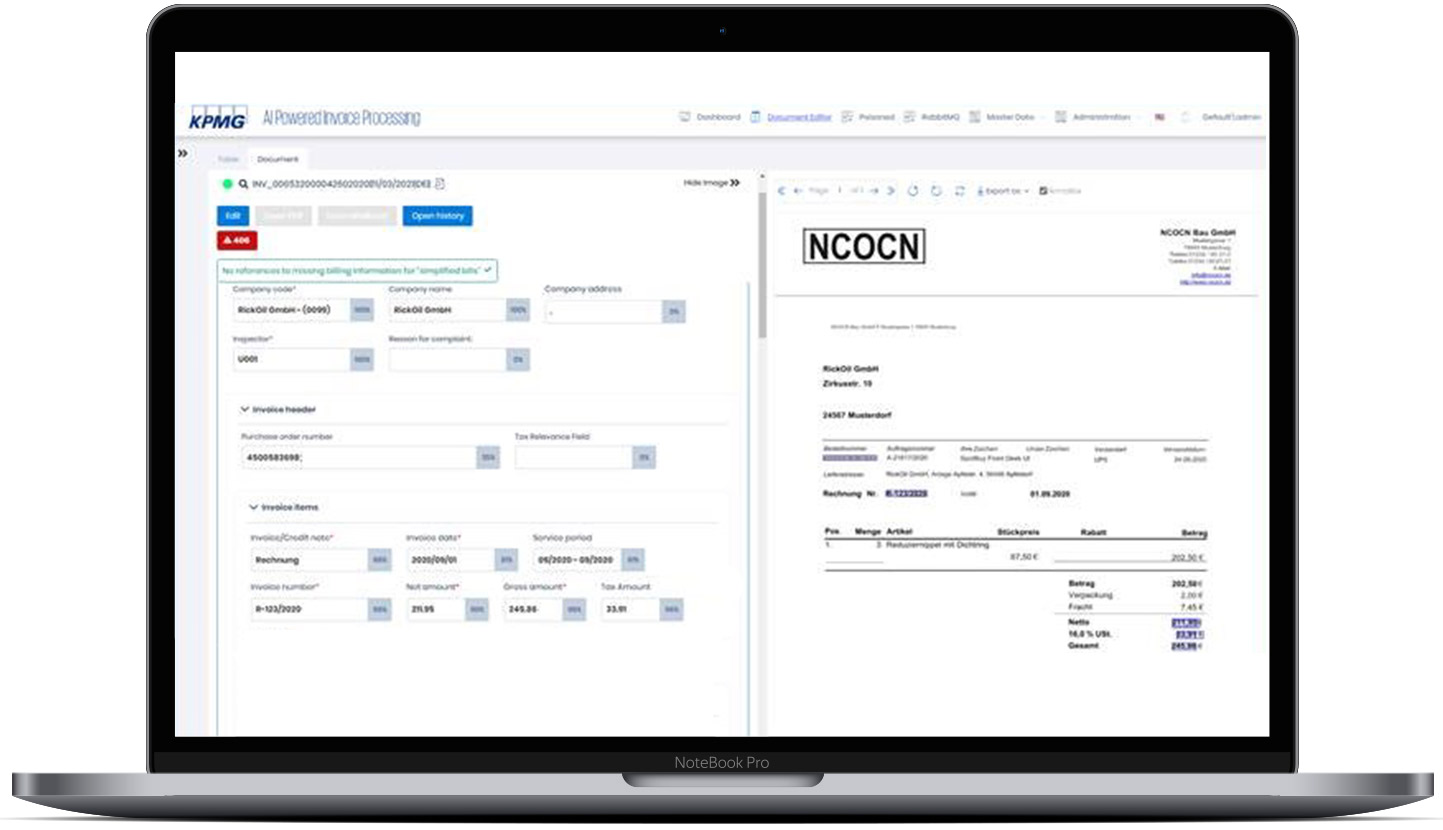

AIPIP enables comprehensive automatic invoice processing, including AI-powered learning capabilities. All information is extracted and then processed by our AI models.Ensuring quality and compliance for bookings

Our solution ensures your compliance! It includes over 80 automated compliance checks that alert accountants to potential issues, preventing incorrect invoice processing.Working on the process

AI-powered invoice processing enables employee capacities to be allocated to value-adding activities, thereby making the relocation to low-wage locations unnecessary. Furthermore, our technology reduces the need for skilled workers in invoice processing, thus helping to mitigate the shortage of skilled labor.

Summary

KPMG AI Powered Invoice Processing is a digital “Quick-win”. For over two years, our AI has shown a significant increase in efficiency in international practical use while simultaneously maintaining and verifying international quality and compliance standards. The implementation of our technology is simple and cost-effective, as it extracts expert knowledge from existing booking data and automates the subsequent manual processing of invoices. Typically, the introduction pays for itself within six to twelve months. Our solution is already in productive use by clients such as Uniper as well as leading insurance and retailer groups.

Key Features

Rapid implementation

The technology is prepared for operational use within a few weeks, during which it learns from its historical booking data and can immediately apply this knowledge. As a first step, we offer a determination of the automation potential for your company's individual requirements as part of our Proof of Value.

Minimally invasive integration

For successful deployment, only the AI core trained in the preliminary study is "minimally invasively" integrated between the invoice receipt and the ERP/workflow system. Optionally, your existing capturing system can continue to be used or replaced by the integrated capturing functionality. For this reason, the implementation is not a large IT project but can be realized as a Quick Win.Automated compliance

In practice, numerous compliance requirements must be considered when booking an invoice. These primarily stem from regulatory, tax, internal control system (ICS), or internal corporate environments. Currently, more than 80 automated checks ensure compliance in the international context.

Overview of Features

Extraction (OCR) - Input Management

- Pre-Processing (De-Skewing etc.)

- Non Invoice Filter (attachment with PDF,JPG)

- View Mail body

- Scan Quality Check

- Handling Non Relevant Documents

- Additional Attachments (File Formats: PDF and others)

- Tracking ID

- Multiple Invoices per Mail

- Acknowledgment

- Automatic Document Type Recognition

- Invoice (non network PO)

- Invoice ( Non-PO)

- Invoice (non network PO)

- Credit notes

- Special Travel Expenses

- Delivery Notes

- Service Entry Sheets

- Batch invoice

- Invoice line Items

- Invoice ( Non-PO)

- Integration of different Input Channels

- User Upload

- PDF invoices

- Scanned Invoices (pdf,jpeg,png)

- E-Invoicing

- Integration of different Input File Formats (eInvoicing)

- Italy

- France

- Spain

- Germany (FeRD)

- England

- Poland

- Capturing of Languages

- German

- French

- Spanish

- English

- Italian

- Polish

- Expandability to additional documents

- Automatic document pickup from source system

- Integration of Market Leading Extraction Providers (OCR)

- AI Accounting - Prediction of Acccounting Values (e.g. G/L Code or VAT code)

- Master Data Enrichment

- Fast Creation of Special Operations through Rules

- Confidence-based processing for controlled automatic processing

- Automated Learning (Tool learns from historic data)

- Multilevel Compliance Checks (best practice standard + full customization)

- Quality Assurance (master data validation)

- IT-Security (Certifications available: ISO 27001, ISO 9001, TISAX Level 3 )

- Automatic Validaton (validation of invoice data with pre configured rules or checks)

- Role Based Access Control (RBAC)

- Selected European tax requirements

- Data protection (GDPR / Schrems II)

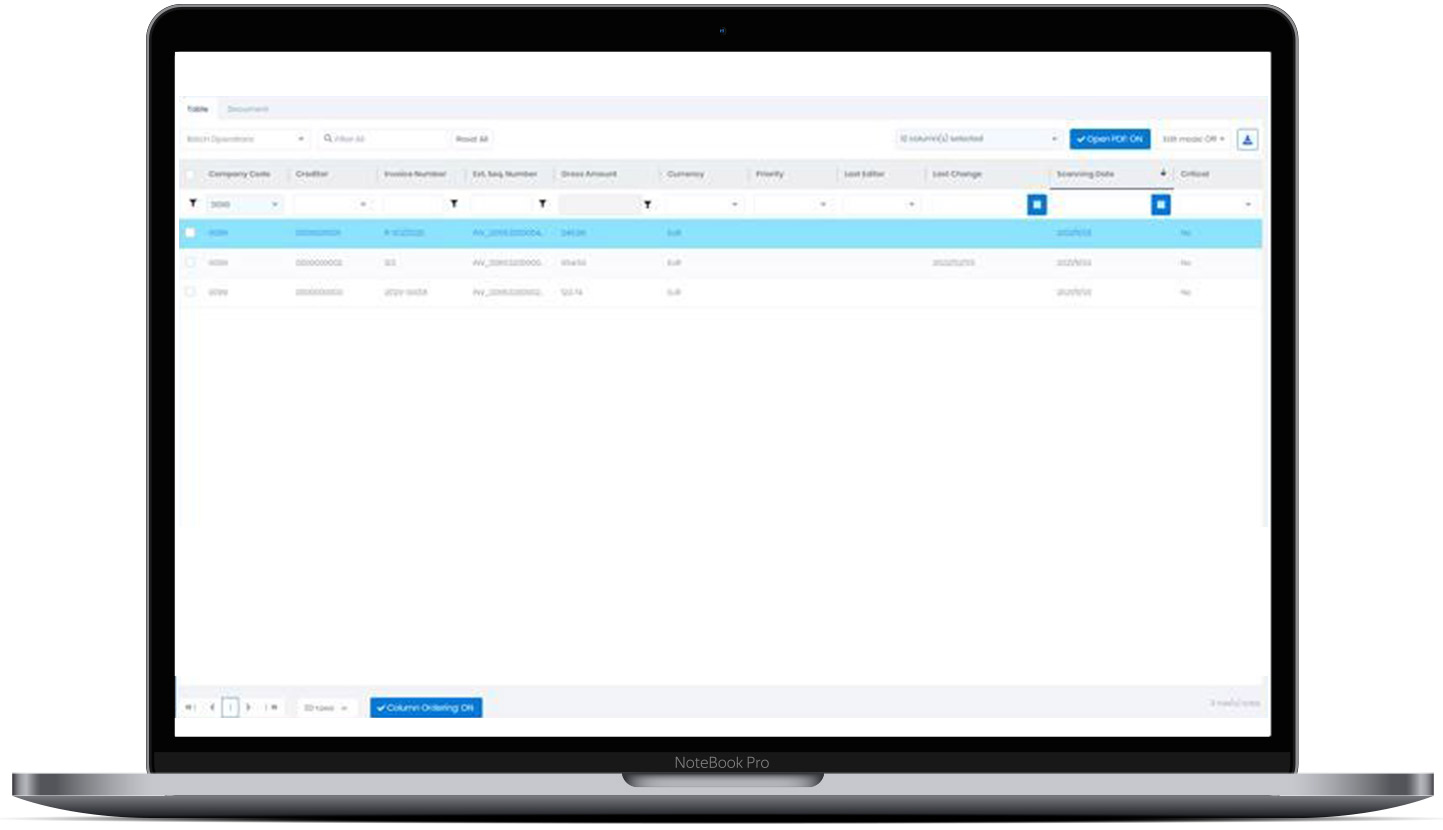

- Exception Handling in user interface

- Integrated Approval Workflow

- Role Based Access Control (RBAC)

- Dual Screen Setup

- Multiple Languages in user interface

- Customer Master Data lookup and availability in frontend

- Cloud based provision in secturity data center

- Interfaces/connection (e.g. SFTP, SAP)

- Permission/Rights management (authorizations, substitute regulation, etc.)

- Minimally-Invasive Integration

- Connectivity to leading OCR providers

- Independence from ERP Systems

- Web Interface

- Standardized SAP Integration

- Reviewer/Approver

- Currency

- Invoice Number

- Company Code/Billing Name

- Invoice Date

- Vendor Address

- Vendor VAT ID

- PO Number

- QR Codes

- Company Code Address

- Vendor Tax ID

- Service Period/Delivery Date

- Scan Date

- Monetary Values (Net-,Tax-, Total Amount)

- Banking information (IBAN, SWIFT, Bank number, Account number)

- Contract Number

- Customer Number

- Payment Terms (Master Data vs. Invoice)

- Net Amount

- Tax Amount

- Tax Rate in %

- Gross Amount

- Item Price

- Quantity

- Unit

- Product/Service Description

- Delivery Note

- PO Match

- Cost Center

- Vendor ID

- Tax Code

- GL Account

- Internal Order

- Country

- Document Type (invoice vs credit note)

- Company Code

- Posting Text

- Approver

- WBS Element

- Accounting for PO-based invoices

- Mapping of delivery notes

- Intelligent accounting wiki

- Thresholds for approvals in terms of invoice value and approval cascades

- Audit log requirements

- User privileges & roles (view/change)

- Notification rules (single/batch)

- Forwarding and back-up rules (e.g. absences)

- Organizational specifics and approvals across functions or for multi-entity involvements (if applicable)

- Two-/three-way-match rule sets

- Approval loops and approval resets in case of declined approvals (escalation)

- Abortion criteria

- Access to approval portal via email notification