Welcome to Deal Advisory Services!

Our digital products combine transaction expertise with the technological competence of our international network. This enables you to efficiently master challenges in the context of transactions or company valuation and make better decisions in the process.

Growth financing and investment

Matchmaker helps you with your search for growth capital to expand your business. Is your start-up planning a new financing round or are you looking for a growth partner?

Find out more

Company disposal and acquisition

Are you looking for a successor or a buyer for your company? Then you've come to the right place! We will connect you with suitable candidates for your company – confidentially, securely and, if you wish, anonymously.

Find out more

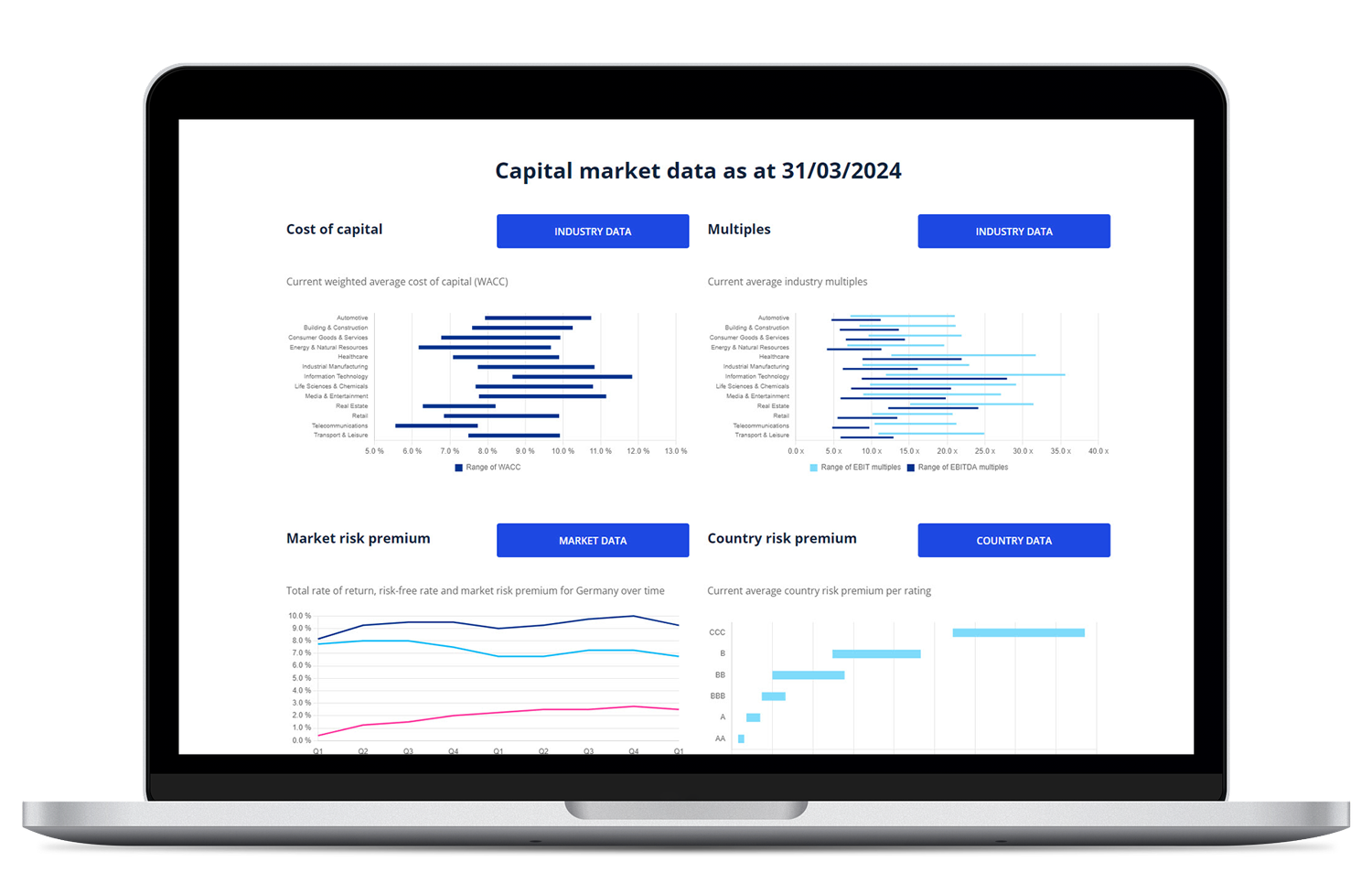

Latest capital market data

Discover the latest capital market data and numerous analyses of cost of capital parameters and multiples. Updated quarterly, you will receive insights into the development of the parameters as well as further information material.