Reduce delivery times significantly with this solution

The uncertainty of today’s fast-paced world is requiring the planning process to evolve to an agile, responsive, and flexible capability.

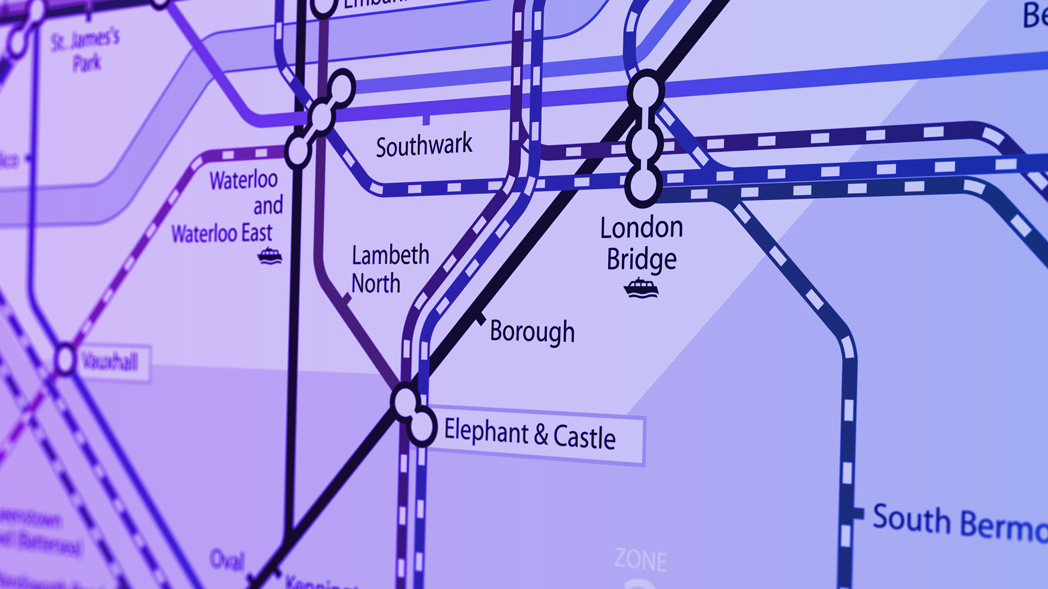

Anticipating and reacting to change means Banks must be able to quickly generate multiple “what-if” forecasting scenarios and evaluate them across numerous dimensions -considering constraints such as capital and liquidity.

This driver-based planning application provides a solution which materially reduces delivery time and helps to address these key questions: • What should the shape of the bank look like across retail asset/liability classes to meet shareholder

return targets within the capital and liquidity constraints? • How can we automate forecasting the Bank’s full Balance Sheet to meet regulatory asks? • How would improved utilization/drawdown rates for cards impact product balances,

income, impairments, direct and indirect costs? • How can we plan and analyze impact of management actions to close the gap between the latest forecast to the Group targets?

Your benefits with our solution

Optimization

Significant reduction in delivery timesPlanning reliability

Agile, responsive and flexible planning processForecast reliability

Creation of multiple "what-if" forecast scenariosYour journey with KPMG Atlas

1

Assess maturity level

With our business analytics you are able to assess the maturity of your organization for the technology of this use case

2

Order use case demo

Order the demo of this use case and get an impression of possible applications of the technology of this use case

3

Discover more use cases

Discover our other use cases to learn more about the technology of this use case and its application areas

_1048x589px.webp?sfvrsn=2c0a5bbf_6)

_1048x589px.jpg?sfvrsn=bc469887_3)